Online retailers are usually too familiar with the term chargeback, which can significantly concern your business. Chargebacks can impact your bottom line and, in some cases, even lead to the closure of your business. Therefore, it is crucial to understand how to reduce chargeback with Customer Service.

In this post, we will provide valuable insights into the concept of chargebacks, their workings, and the various reasons behind them. We will also explore the different types of chargeback fraud, which include criminal fraud charges, merchant error charges, and friendly fraud charges.

We will delve into various strategies businesses can use to prevent chargebacks, including managing them with the help of customer support. We’ll also explore how merchants can reduce their chargeback rates and the benefits of implementing a chargeback alert system. By the end of this post, you will better understand what chargebacks are, how they work, and how to prevent them from happening. You’ll also learn how a robust Customer Service strategy can help you win the chargeback battle.

So, without further ado, let’s dive in!

What is a chargeback?

Definition of a chargeback

A chargeback refers to a reversal of a credit card transaction by the issuing bank. This usually occurs when customers dispute charges on their statements and request refunds. The Merchant then has to provide evidence that the transaction was legitimate, or else the card issuer may reverse the transaction and refund the customer. The dispute settlement procedure finishes only when one party accepts responsibility for the payment or when the card scheme settles the issue, whichever occurs first.

Chargebacks are designed to protect consumers from fraudulent or unauthorized transactions but can be a significant financial burden for merchants.

By 2023, global chargeback volumes are expected to nearly double the 2019 figures, surpassing 250 million disputed transactions.

Resolving these disputes and preventing chargebacks is more complex than ever. The 2023 Payments Market Outlook reports that chargebacks will represent a cost of more than $1 billion by 2023 paid by businesses, in addition to the amounts disputed and revolved.

Every e-commerce business suffers from chargebacks. Online stores experience chargebacks more frequently and face more significant difficulties in defending against them because transactions occurring without the physical presence of the card have a higher potential for fraud. E-commerce businesses have to develop strategies to avoid chargebacks from occurring in the first place. However, when they happen, the merchants can still contest these refunds and have them overturned.

Consequences of Chargebacks on Merchants

A high rate of chargebacks can have severe consequences, including financial loss, fines and penalties, reputation damage, and difficulty obtaining payment processing services:

- Financial Loss

Chargebacks can be costly for merchants, especially if they have a high rate of chargebacks. When a chargeback occurs, the Merchant is typically responsible for the transaction’s cost and any additional fees or penalties associated with the chargeback. They can add up quickly and result in significant financial losses for the Merchant.

- Fines and Penalties

Merchants with a high chargeback rate may face financial losses, fines, and penalties. Card schemes and payment processors typically have rules and regulations that merchants must follow, including chargeback thresholds. If a merchant exceeds these thresholds, they may be subject to fines, penalties, or account suspension or termination.

- Reputation Damage

High chargeback rates can also damage a merchant’s reputation. Consumers may view a merchant with a high chargeback rate as unreliable or untrustworthy, leading to decreased sales and revenue.

- Difficulty Obtaining Payment Processing and Financial Services

Merchants with high chargeback rates may have difficulty obtaining payment processing services in the future. Payment processors may view these merchants as high-risk and hesitate to work with them.

To avoid these consequences, this blog article will discuss the proactive steps Merchants should take to reduce their chargeback rates and how they should prepare and finesse their strategy to dispute the chargeback.

How does a chargeback work?

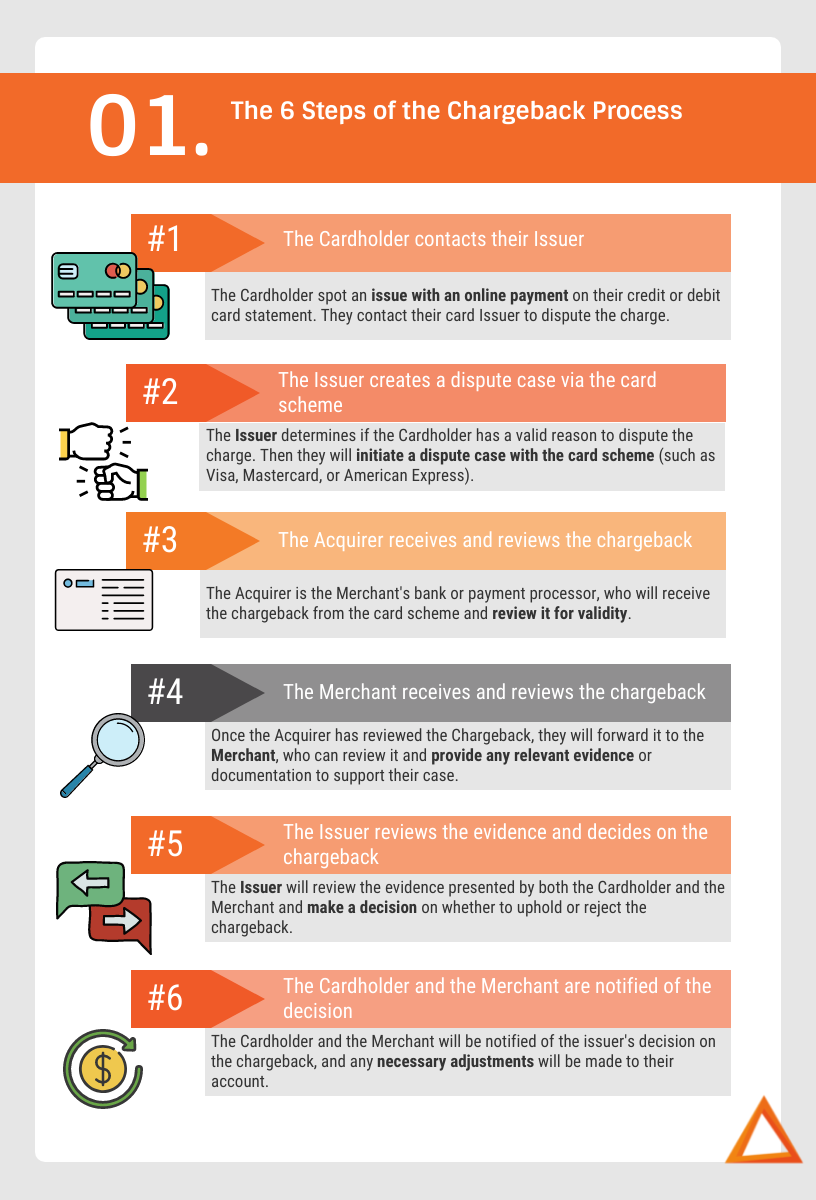

Whenever a cardholder disputes a transaction, the chargeback procedure begins. Before its resolution, it goes through several stages—although the course can vary significantly depending on which card scheme is involved.

First, it is essential to understand the multiple parties involved in a chargeback procedure:

- The cardholder is the individual who made the original purchase at the merchant’s store using their credit or debit card. The Cardholder initiates the dispute by contacting their card issuer to initiate a chargeback.

- The Issuer is the bank or financial institution that issued the card used for the original purchase. To start the chargeback process, they create a dispute case with the relevant card scheme (such as Visa or Mastercard).

- The Merchant is the seller’s business that made the original sale. They receive and review the chargeback to determine whether to dispute or accept it.

- The Acquirer is the bank or financial institution that processes the payment on behalf of the Merchant. They receive and review the chargeback on behalf of the Merchant.

The chargeback process comprises six stages:

- The Cardholder contacts their Issuer.

- The Issuer creates a dispute case via the card scheme.

- The Acquirer receives and reviews the chargeback.

- The Merchant receives and reviews the chargeback.

- The Issuer reviews the evidence and decides on the chargeback.

- The cardholders and merchants will be notified of the decision.

The time limit for chargeback filing varies according to the card scheme and the reason code. The clock begins when the Issuer creates a dispute case through the card scheme, not when the Merchant receives the notification of the potential dispute or chargeback.

Resolving a chargeback can take a few days to several months, depending on the case’s complexity and other factors.

Understanding the main reasons for chargebacks

Because they involve numerous parties and must consider domestic and foreign financial rules, data regulations, and other legislation—not to mention the intricacies of chargeback procedures—”complex” is a good word to describe them.

When an Issuer initiates a chargeback against an Acquirer, the reason for the dispute must be specified. This makes it easier for all parties to understand why a particular chargeback has occurred. Each of the four major credit card networks (i.e., Visa, Mastercard, American Express, and Discover) uses its terminology and codes to group the reason for the chargeback.

The 4 Main Categories of Chargeback

The Issuer can initiate a chargeback for the following categories:

- Fraud. The buyer was not informed of or permitted the transaction.

- Cardholder Disputes. The cardholder claims they did not receive the goods or services they paid for or that the goods or services were not as described.

- Authorization. The Issuer can file an Authorization chargeback if a transaction amount exceeds the authorized amount, if it spots a mismatch of transaction data (such as card number or expiration date), or if it declines due to insufficient funds.

- Processing error. Processing errors occur when the merchant or issuer does not process a transaction correctly, such as duplicate processing, incorrect transaction amount, or incorrect currency.

- Miscellaneous/Other.

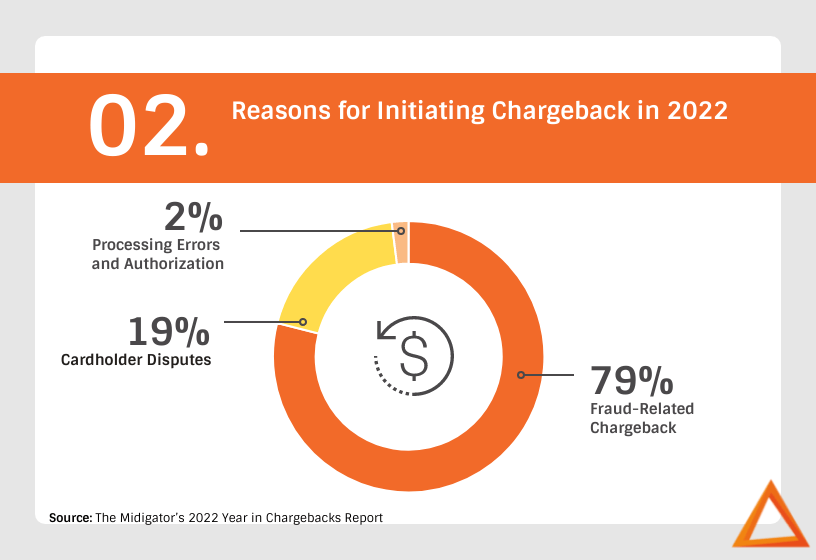

The Midigator’s 2022 Year in Chargebacks Report found Fraud-related disputes to be the most common cause of chargebacks. They accounted for 79% of the chargebacks initiated in 2021. The second highest category of chargebacks was Cardholder Disputes, accounting for 19% of the total during that period. Meanwhile, Processing Errors and Authorization issues combined accounted for less than 2% of chargebacks.

Let’s examine fraud-related chargebacks by breaking them into three categories: third-party (criminal), first-party (friendly), and Merchant.

Criminal Fraud Chargebacks

Criminal fraud occurs when a third party (i.e., a fraudster) uses stolen data to make unauthorized purchases.

Here are some examples of criminal fraud chargebacks:

- Stolen Credit Card: A criminal may steal and use a credit card to make fraudulent purchases. The cardholder may not notice the unauthorized charges until they receive their credit card statement. At this point, they will dispute the charges with their bank.

- Identity Theft: A criminal may steal someone’s personal information, such as their name, address, and social security number, and use it to open credit accounts and make fraudulent purchases. The victim may not realize that their identity has been stolen until they receive a credit card statement or collection notice for an account they never opened.

- Account Takeover: A criminal may gain access to a victim’s online accounts, such as their bank account or e-commerce account, and make fraudulent purchases or transfer money out of the account. The victim may not notice the unauthorized activity until they review their account activity or receive an alert from their bank.

- Phishing: A criminal may send a fraudulent email or text message that appears to be from a legitimate company, such as a bank or e-commerce site, and ask the victim to provide their personal information, such as their login credentials or credit card number. The criminal can then use this information to make fraudulent purchases or transfer money from the victim’s account.

One of the first examples of a case involving criminal fraud chargebacks is the Albert Gonzalez case. Gonzalez was a hacker who stole more than 170 million credit card numbers from retailers, including TJ Maxx and Heartland Payment Systems. He and his accomplices then used the stolen credit card numbers to make fraudulent purchases and sell the information on the black market. The victims of the fraud would dispute the charges with their banks, resulting in chargebacks for the retailers. Gonzalez was eventually caught and sentenced in 2008 to 20 years in prison and to pay USD 25 million in restitution.

Friendly Fraud Chargebacks

Banking apps allow cardholders to file complaints about a purchase easily without contacting the seller. This has raised concerns among the merchant community as they are left unable to solve the issue before the dispute is filed. 81% of Cardholders have admitted to filing a chargeback out of convenience. In their mind, contacting the bank for a chargeback was more straightforward than calling the Merchant for a refund.

Examples of Friendly Fraud Chargeback:

- “I didn’t receive my package“: A customer may claim that they never received their package, even though tracking information shows it was delivered. Sometimes, the customer may have forgotten that they received the package, which may have been delivered to a neighbor or stolen from their doorstep.

- “I didn’t make this purchase“: A customer may claim they did not purchase, even though the transaction was made using their credit card. This may occur if the customer’s credit card information was stolen or someone else in the household purchased without the customer’s knowledge.

- “The product was not as described“: A customer may claim that the product they received did not match the description on the website, even though it was accurately described. This may occur if the customer did not fully read the product description or if they had unrealistic expectations.

Merchant Error Chargebacks

Faulty business practices are bound to lead to chargebacks.

Here are common examples of Merchant Error Chargeback:

- Duplicate Transactions: A Merchant may accidentally charge a customer twice for the same purchase, resulting in an overcharge.

- Incorrect Amount Charged: A Merchant may charge the wrong amount for a purchase, either overcharging or undercharging the customer. The customer may dispute the amount with their bank, resulting in a chargeback.

- Product Not Received: A Merchant may fail to deliver a product or service paid for by the customer.

- Canceled Transactions: A Merchant may charge a customer for a canceled or refunded purchase.

- Defective or Damaged Products: A merchant may sell a defective or damaged product to a customer.

How can businesses reduce their chargebacks?

The Midigator’s 2022 Year in Chargebacks Report mentions that in 2021, by combining multiple solutions, merchants could stop up to 50% of disputes from becoming chargebacks.

Chargebacks can be a frustrating and costly problem for businesses that accept credit card payments, particularly for eCommerce businesses that conduct a high volume of transactions. The Cardholder’s bank can initiate chargebacks for various reasons, including fraud, quality issues, clerical errors, and technical problems. Therefore, merchants need to implement both chargeback prevention and management strategies.

It is essential to have a plan for handling chargebacks that do occur alongside prevention. Chargeback management involves responding promptly and effectively to disputes to increase the chances of recovering lost revenue.

Chargeback Prevention Strategies

Merchants should implement a multi-layer approach to fraud management to mitigate chargeback risks. They can use fraud filters and customize rule sets to reduce risk without losing revenue. Vendors can also use complementary tools and get extra help by hiring outsourced customer support to follow up with clients regarding order confirmation, shipping policy, and tracking to avoid missing out on registered orders.

Use fraud prevention tools.

Friendly fraud can be challenging to detect with traditional fraud management tools, but Merchants have a variety of fraud prevention tools at their disposal, such as:

- Two-Factor Authentication,

- Device Fingerprinting,

- Velocity Checking,

- Machine Learning Tools to identify potential fraud.

In addition to taking steps to prevent chargebacks, businesses also need to have a plan in place for managing chargebacks that do occur. This may involve investigating suspicious orders, calling customers to inform them of the business’s policies, and negotiating with the Customer to cancel the chargeback request.

Subscribe to a chargeback alert system.

Chargeback alerts will cut down on chargebacks. Chargeback alerts notify you each time a customer raises a complaint. You will have a chance to settle the disagreement before a chargeback occurs.

The Cardholder typically deals with their issuing bank during the chargeback procedure. The Merchant is usually unaware of the issue until the chargeback is reported to them after the event.

However, a chargeback alert lets you know when one is pending before affecting the Merchant’s chargeback ratio. In this situation, you can contact the consumer and handle the disagreement away from the payment system. You can then prevent a chargeback for, at most, the refund cost. The option to let the process proceed and contest the chargeback is always available if the Merchant thinks the request is invalid.

Subscribing to chargeback prevention alerts costs the Merchant money. In the long run, however, they may be more cost-effective for a business than dealing with the expenses and lost revenue associated with a suspended or terminated account.

The main Chargeback alert providers are:

- Ethoca Alerts. Mastercard acquired Ethoca in April 2019.

- Verifi Alerts. Visa acquired Verifi in July 2019.

Verifi has broader coverage in the U.S., while Ethoca is better suited to international merchants in Canada, Europe, and Asia.

However, there is some overlap between them. Merchants who want to maximize alert coverage by using both providers may have a problem with duplicate alerts (and double fees). To avoid overpaying for redundant alerts, merchants must balance cost and coverage that sufficiently addresses their specific needs.

Consider Delaying the Billing

Wait to charge cards before shipping the goods. It should help prevent disputes related to “non-receipt of merchandise.” Customers can get confused if they see transactions on their statements before goods arrive, which leads to a preventable dispute.

Just as it’s best not to submit transactions too early, don’t submit them too late, either. You will minimize “late presentment” or “credit not processed” disputes.

Use a clear billing descriptor on customer statements

Check that the Customer can easily understand the billing descriptor on statements. They should be able to identify the purchase immediately so they don’t mistakenly initiate a dispute.

Make an explicit Policy for Returns, Refunds, and Cancellations.

Merchants can take proactive steps to reduce the risk of chargebacks and improve their profitability by communicating their policy for returns, refunds, and cancellations during the sale. When customers know that a Merchant has a transparent and fair policy for returns, refunds, and cancellations, they are more likely to trust the Merchant and feel more satisfied with their purchases.

Likewise, Customers who understand the Merchant’s policies are more likely to make informed purchasing decisions and less likely to initiate chargebacks due to confusion or miscommunication.

Nevertheless, when a dispute occurs, an explicit policy can help the Online Store provide evidence that they acted within their stated guidelines. The Issuer will be less likely to uphold the chargeback.

Several card schemes and payment processors require merchants to have a clear and explicit policy for returns, refunds, and cancellations. Failure to comply with these requirements can result in fines or other penalties.

Chargeback Management Strategies

Even with the best prevention strategies, chargebacks can still occur. Therefore, having an effective chargeback management plan is crucial. Merchants can set up chargeback management strategies like investigating suspicious orders, calling customers to inform them about store policies, and negotiating with the final client to cancel the chargeback request. By having effective chargeback prevention and management strategies, merchants can reap various benefits.

If a chargeback occurs, the Merchant should call the Customer to inform them of their store’s policies and resolve the issue amicably. In some cases, it may be possible to negotiate with the Customer to cancel the chargeback request.

Various issuing banks have joined chargeback alert networks, which alert the Merchant when a cardholder from a participating bank disputes a transaction. The Merchant can then refund the transaction and avoid a chargeback.

It’s essential to keep accurate records of all transactions, including copies of receipts, invoices, and shipping information. When disputing a chargeback, these records will be used to prove the sale was legitimate.

Chargebacks can be costly and frustrating for Online Stores. However, implementing chargeback prevention and management strategies can mitigate risks and recover revenue. By taking a multi-layer approach to fraud management, signing up for chargeback alerts, and making it easy for customers to reach the store, merchants can discourage friendly fraud and illegitimate chargebacks.

By investigating suspicious orders, calling customers, and negotiating with the final client, merchants can effectively manage chargebacks and avoid penalties.

How to Reduce Chargeback with Customer Service

Here, we will review the connection between effective Customer Service and Chargeback reduction.

Facilitate Access to Customer Service.

Make sure Customers know how to reach you. Propose as many communication channels as possible, including chat, social media, email, and phone. Attentive and accommodating, 24/7 Customer Service can work wonders to help you avoid chargebacks from disgruntled customers.

Customer Service teams can answer customers’ inquiries about the shipping process. They will inform them when orders will be shipped and when they should arrive.

Reduce Chargeback with Effective Customer Service.

Always get a quick response. Leaving a message from an unhappy customer unanswered is an invitation to a chargeback.

Ensure the Customer Service staff is perfectly trained on your products, services, and procedures. Your business can get assistance from an outsourced Customer Service team who will resolve complaints promptly and thoroughly in the first instance. It will often avoid potential chargebacks later and keep the procedures for customer billing queries, printed receipts, delivery dockets, and claims under constant review.

Send an auto-responder to all email inquiries, informing customers when they can expect a personal response. Monitor social media and quickly address any customer concerns with courtesy.

Confirm Customer Orders.

Confirming customer orders is a good business practice, as it helps prevent unnecessary disputed payments. If you accept orders for goods or services to be delivered later, manage the Customer’s expectations. Keep them updated on delivery times and allow them to track their order.

Let the Customer know if goods are out of stock, no longer available, or the delivery is delayed. Offer the option of purchasing an alternative or canceling the order. This may help prevent chargebacks for “services not provided” or “merchandise not received,” two of the most common reasons for disputed payments.

Obtain Proof of Customer Participation.

Providing compelling evidence that the Customer participated in the transaction and/or received the goods helps defend some chargebacks. Configure your internal processes with the help of outsourced Customer Support to capture the Customer’s account order history, clearly showing all transactions. Customer support will collect and retain the Customer’s signed delivery receipts and courier tracking documentation.

Cancel Recurring Transactions Promptly.

As a best practice, an online Merchant should be able to cancel recurring transactions promptly. Confirm the cancellation to the Customer in writing and by calling, stating the effective cancellation date.

When the Customer has paid up front for a subscription or membership of a pre-agreed duration, the Support team should also clearly state any cancellation restrictions that may apply. The customer can also ask for another form of payment for the remainder of their subscription or membership, as appropriate.

Update Expired Cards

When the Customer’s card expires, there’s a probability of incurring chargebacks, losing sales, or missing payments.

Keep track of such information, and maintain the following up with customers through the Customer Support services that prompt customers for new card details, which will help you maximize revenue and reduce churn.

Negotiating the Chargeback with the Cardholder

Customer Service teams can play a crucial role in negotiating chargebacks with Cardholders. A refund is an option, but not the only one.

The Outsourced Customer Service provider will identify exceptional performers dealing with chargeback disputes. They will be well-trained in chargeback procedures and should possess strong communication and problem-solving skills. They should also be patient and clarify unclear issues while handling difficult customers. The representative should propose a resolution that meets the cardholder’s needs and is within the company’s policies.

Customer Service teams must maintain a customer-centric approach while protecting the company’s interests. They must balance customer needs with company policies to effectively negotiate chargebacks and build stronger customer relationships.

Conclusion

Chargebacks can be a major headache for Merchants, but they can be managed and even prevented with the right strategies. Merchants can reduce Chargeback with Customer Service. This strategy is crucial, as it can help address issues before they escalate into disputes. By facilitating access to Customer Service, providing exemplary service, and confirming orders, merchants can build trust with their customers and minimize the risk of chargebacks.

Moreover, obtaining proof of Customers’ participation, providing clear and concise documentation of transactions, and negotiating with Cardholders in good faith can help merchants successfully challenge unwarranted chargebacks. So, if you’re looking to protect your business from chargebacks, investing in Customer Service is a smart move that can pay off in the long run.

If you struggle to manage chargebacks and provide effective customer service, consider working with a partner like NAOS CX. Our team of outsourcing experts can help you implement the strategies outlined in this post and provide additional tools and insights to optimize your Customer Service and chargeback management.

Don’t wait until it’s too late to protect your business from chargebacks – contact NAOS CX today to learn more about our services and how we can help you grow your business.

2 comments

Pingback: 2024 Hottest Trends in Ecommerce Customer Support | CX Blog

Pingback: Advantages of Customer Experience Outsourcing | CX Blog

Comments are closed.