Egyptians and Digital 2025: What You Need to Know

If you’re planning digital campaigns, product launches, or policy initiatives in Egypt, you need a clear view of where connectivity, speeds, and social-media engagement stand today—and where they’re headed. That’s precisely what this deep dive delivers.

For four years running, Digital Egypt Blog has unpacked DataReportal’s annual “Egyptians and Digital” studies, helping marketers, operators, students, and decision-makers stay ahead of the curve. Our previous analyses, as outlined in the 2022 report, 2023 report, and 2024 report, have collectively garnered over 50,000 views and been widely shared across LinkedIn and industry forums, making this blog your go-to source for trusted, in-depth insights.

Reading this article, you’ll clearly understand Egypt’s internet-penetration growth, infrastructure gaps, platform-specific trends, and gender dynamics—and know exactly where to focus your next investment or campaign to win in Egypt’s fast-evolving digital landscape.

EXECUTIVE SUMMARY & KEY TAKEAWAYS

- Internet leaps ahead: Egypt’s online population jumped from 82.0 M (72.2%) in Jan-24 to 96.3 M (81.9%) in Jan-25—a net gain of 9.7 percentage points (pp) in penetration.

- Rural areas still lag behind: Urban internet penetration stands at 84% compared to just 63% in rural areas—a 21 percentage point gap that represents approximately 24.5 million offline rural Egyptians.

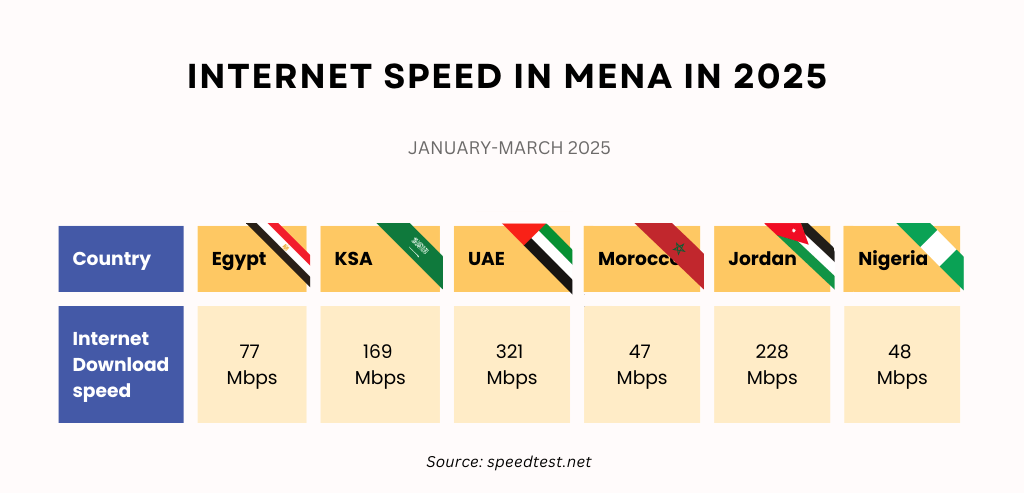

- Speeds climbing—but gap remains: Median fixed-broadband rose to 76.7 Mbps (vs. Nigeria’s ~47.5 Mbps), yet trails the UAE’s 321 Mbps by fourfold.

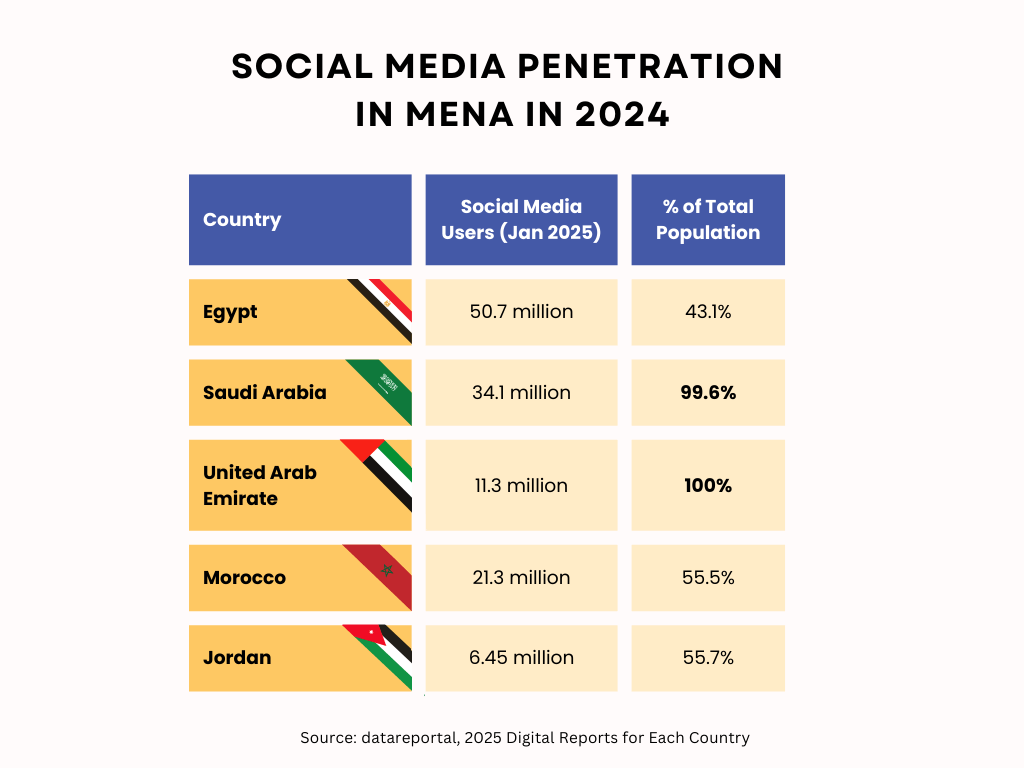

- MENA’s largest social-media audience: 50.7 M active users (43.1% of population)—the biggest pool in the region, yet with the social media penetration rate below Gulf peers.

- Women are still behind—but closing in: The female share of social media users jumped from 39.0% to 41.5% in 2024, narrowing the gender gap by 2.5 percentage points—yet men still comprise 58.5% of the audience.

⚠️ Gender-Gap Alert

Despite adding millions of women online in 2024, women still make up just 41.5% of social media users, leaving a nearly 17 percentage point gap to close. Targeted digital-inclusion efforts are needed, especially in rural areas.

🚀 5G Milestone

Over $2 billion of telecom capex in 2024—and EGP 18 billion more pledged for 2025—sets the stage for Egypt’s first nationwide 5G roll-out and further boosts in speed and coverage.

INTERNET USAGE IN EGYPT

Internet Penetration

As of January 2025, Egypt’s population reached 117 million, marking a 1.7% increase from the previous year. The number of internet users increased substantially to 96.3 million, up from 82.01 million in 2024, thereby elevating the internet penetration rate from 72.2% to 81.9%. This 14.6% growth signifies a robust shift toward digital connectivity, with approximately 21.2 million individuals still offline at the start of 2025.

Deep-Dive: Egypt’s Urban vs Rural Digital Divide

While Egypt’s national internet-penetration figure climbed to 81.9 percent in early 2025, that headline masks a persistent gap between urban and rural areas.

| Segment | % of population | Internet penetration | Estimated users | Estimated offline |

| Urban | 43.4 % (≈ 50.8 M people) | 84 % | ≈ 42.7 M | ≈ 8.1 M |

| Rural | 56.6 % (≈ 66.2 M people) | 63 % | ≈ 41.7 M | ≈ 24.5 M |

DataReportal indicates that 43.4% of Egyptians reside in urban centers, while 56.6% live in rural areas.

The Internet Society Pulse (2022) reports that 84% of internet use in Egypt occurs in urban areas, compared to 63% in rural districts. That penetration gap means that some 24.5 million rural Egyptians remain offline, three times the roughly 8 million urban dwellers without internet.

Why the divide persists

- Infrastructure concentration: Fiber-to-the-home and high-capacity VDSL upgrades have primarily focused on Cairo, Alexandria, and other major metropolitan areas, leaving many villages with legacy 3G or un-upgraded DSL lines.

- Economic & energy barriers: Lower average incomes and less reliable power in rural regions raise both the cost and complexity of extending high-speed networks. The GSMA finds that in Low- and Middle-Income Countries, adults in rural areas are, on average, 28 percent less likely than their urban peers to use mobile internet, reflecting affordability and coverage challenges.

Implications

- Huge untapped audience: Bringing rural penetration from 63 percent to even the national average would add ~12 million new internet users—a 12 percent uplift in Egypt’s online population.

- Social-economic impact: Expanded rural connectivity enables e-learning, telemedicine, digital agriculture, and e-commerce, narrowing regional inequalities.

These “last-mile” challenges underscore why operators and policymakers have earmarked new investments for 2025, ranging from the construction of new towers in underserved governorates to the rollout of fibre-optic networks in smaller towns (see the paragraph below on Investments in Telecom).

Internet Connection Speeds

The quality of internet connectivity in Egypt also improved notably. Median mobile internet download speeds increased from 22.11 Mbps in 2024 to 24.17 Mbps in 2025. Fixed internet download speeds experienced a more pronounced improvement, rising from 64.53 Mbps to 76.67 Mbps. These advancements reflect ongoing investments in Egypt’s telecommunications infrastructure.

We see how far Egypt’s networks have come in a single year and how much further they can go before matching the region’s speed frontrunners. Here’s the median fixed-broadband download-speed breakdown for Egypt, Nigeria, and the same MENA peers we looked at for social-media penetration (all speeds in Mbps, January–March 2025):

- Egypt’s 76.7 Mbps lead over Nigeria’s ~47.5 Mbps is clear, but it falls short of its Gulf peers.

- The UAE’s networks deliver a median speed of over 300 Mbps—roughly four times Egypt’s speed—while Jordan and Saudi Arabia also outpace Egypt by 3 times and 2 times, respectively.

- Morocco’s fixed broadband speed (46.8 Mbps) is nearly identical to Nigeria’s, underscoring Egypt’s position in the regional speed hierarchy.

Closing that performance divide will require sustained—and substantial—investment. The following section examines the major infrastructure outlays made in 2024 and the bold capex commitments operators have already announced for 2025, laying the groundwork for Egypt’s next leap in connectivity.

Investments Made in Telecommunications Infrastructure

In 2024, Egypt made significant strides in upgrading its telecommunications infrastructure, driven by over $2 billion in investments from telecom operators. This included expanding the number of communication towers to 37,000 and issuing long-term 5G licenses to key players, such as Telecom Egypt, Vodafone, Orange, and e& Egypt, marking a significant turning point in the country’s digital transformation.

At the same time, Egypt expanded its international connectivity through new submarine cable initiatives, reinforcing its ambition to become a regional digital hub.

In parallel, the local data center market experienced strong momentum, reaching a value of $278 million and attracting new operators, including Africa Data Centres and Khazna. This growth is driven by the increasing demand for cloud services and the integration of artificial intelligence (AI).

In 2025, 5G services will be rolled out, and further infrastructure improvements will be implemented. E& Egypt announced plans to invest EGP 18 billion (approximately $363 million) in infrastructure and networks across the country by 2025. The foundations laid in 2024 demonstrate Egypt’s intent to build a future-proof digital economy capable of supporting innovation, smart cities, and global connectivity.

SOCIAL MEDIA ENGAGEMENT

Trends in the Active Social Media Users in Egypt in 2024

Social media usage expanded in tandem with the growth of the internet. By early 2025, there were 50.7 million active social media users in Egypt, representing 43.1% of the total population, up from 40% in 2024. This growth underscores the deepening integration of social platforms into Egyptians’ daily lives.

Below is how Egypt’s social-media penetration stacks up against a handful of other MENA countries in January 2025:

https://datareportal.com/reports

Key takeaways:

- Egypt’s 43 percent social media penetration is significantly below that of the Gulf markets (Saudi Arabia and the UAE, which have essentially universal adoption).

- It also lags behind Morocco and Jordan (both at around 50 percent), suggesting room for growth, especially in rural areas and among underrepresented demographics.

- While Egypt’s social media penetration falls behind Gulf markets and North African peers, its 50.7 million users still constitute the largest social media audience in the MENA region—and leave ample room for further growth.

Platform-Specific Trends

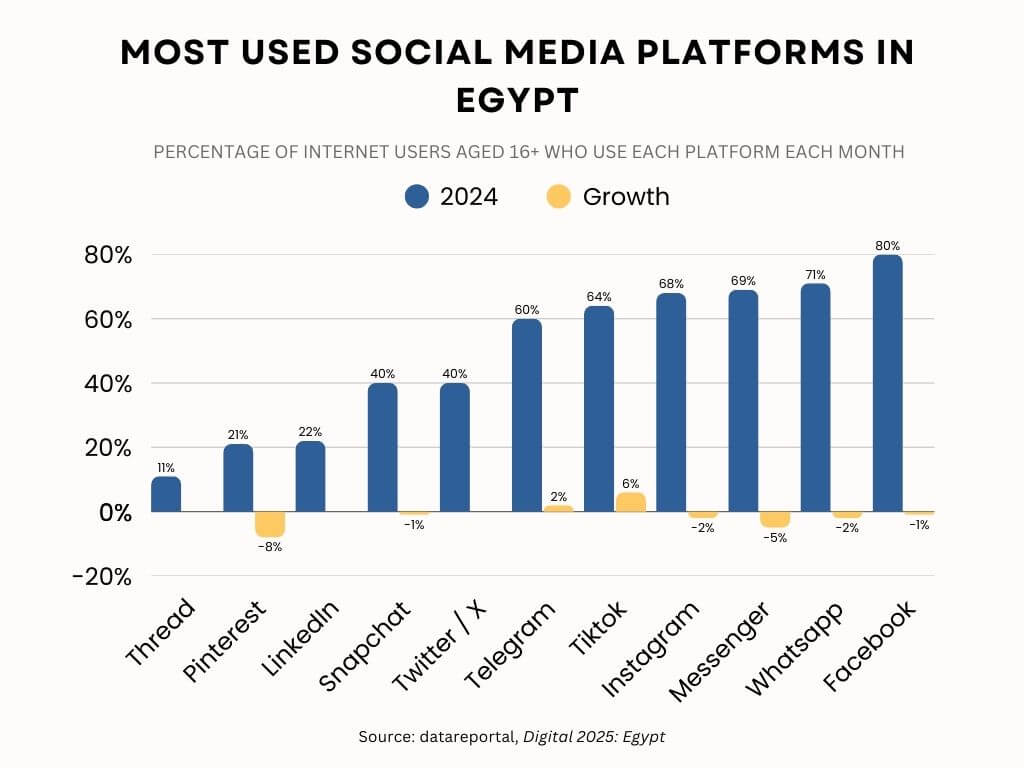

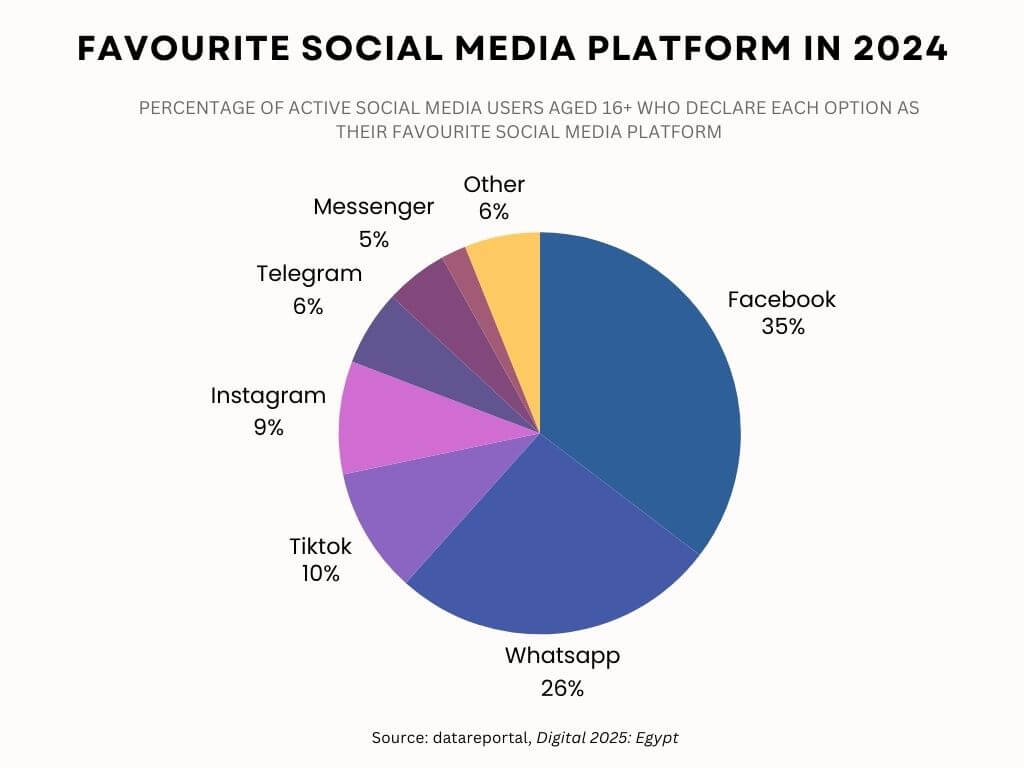

- Facebook: Maintained a substantial presence, with ad reach equating to 50.5% of the local internet user base in 2025. The gender distribution was 39.4% female and 60.6% male. While its reach dipped slightly, it still leads favourites (35 % see the Favourite Social Media Platform circular graphic below).

- Instagram: User numbers grew to 20.1 million in 2025 from 18.15 million in 2024. This represents 17.1% of the total population and 23.5% of the eligible audience aged 13 and above. The platform’s ad reach covered 20.8% of the local internet user base, with a gender split of 46.9% female and 53.1% male.

- TikTok: It experienced remarkable growth, with users aged 18 and above increasing from 32.94 million in 2024 to 41.3 million in 2025. This indicates that TikTok ads reached 56.1% of the adult population, up from 46.7% the previous year, reflecting the platform’s growing popularity among Egyptian adults.

- Messenger: In 2025, the platform’s ad reach encompassed 36.8% of the local internet user base, with 39.9% of the audience being female and 60.1% male, indicating its continued relevance in digital communication.

High reach doesn’t always translate into platform love. Legacy giants (Facebook, WhatsApp) remain indispensable for broad connectivity, while fast-growing challengers (TikTok, Telegram) punch above their weight in “favourite” status, hinting at shifting loyalties among younger, more engaged cohorts.

Top Social Media Platforms and Influencers in Egypt

In terms of individual influence, notable Egyptian figures have amassed substantial followings across various platforms:

- Instagram:

- Mohamed Salah (@mosalah) – 64.6 million followers

- Tamer Hosny (@tamerhosny) – 39.1 million followers

- Mohamed Ramadan (@mohamedramadanws) – 33.3 million followers

- TikTok:

- Gehad hassan👸🏻@gehadhassann – 7.5 million followers

- Ahmed Helmy @ahmedhelmy – 6.9 million followers

- MBC مصر @mbcmasr – 4.6 million followers

Source: https://starngage.com/app/global/influencer/ranking/egypt

Gender Dynamics in Social Media

Although women make up roughly half of Egypt’s population, they have historically been underrepresented among social-media users—until a recent uptick in 2024.

|

Year |

% of Egypt’s total population who are female | % of social-media users who are female |

Change in female share (pp) |

| 2021 |

49.5 % |

38.3 % |

– |

| 2022 |

49.4 % |

39.1 % |

+0.8 |

| 2023 |

49.0 % |

39.0 % |

–0.1 |

| 2024 |

49.5 % |

41.5 % |

+2.5 |

Key takeaways:

- Persistent under-representation (2021–2023): Although women are ~49 % of Egypt’s population, they accounted for just ~38–39 % of social-media users from 2021 through 2023.

- Notable improvement in 2024: Female share jumped by 2.5 pp (from 39.0 % → 41.5 %), suggesting recent efforts—whether better network reach in rural areas, targeted digital-literacy programmes, or platform features—are beginning to narrow the gap.

- Still, a gap remains: Even at 41.5%, women remain significantly fewer than men (58.5%) on social media, leaving a nearly 17-point gender gap to close.

Platform-level nuance (2022 vs. 2024)

| Platform | Female % of users (2022) | Female % of users (2024) | Δ Female share (pp) | Male-skew impact |

| 47.1 % | 47.3 % | +0.2 | Remains the most gender-balanced platform. | |

| 39.2 % | 39.4 % | +0.2 | Legacy skew persists, with little change. | |

| TikTok | 38.3 % | 35.8 % | –2.5 | Female share fell despite absolute growth. |

| Telegram | 43.0 % | 42.0 % | –1.0 | A modest decline in the female proportion. |

Instagram continues to offer near-parity for women, while TikTok’s explosive growth has been driven more by new male users, pulling its female share down even as total female user counts rise.

Comparison with Digital Media Vs Traditional Media

Traditional media, particularly television, remains a significant presence in Egyptian households. Television remains the most popular medium, reaching nearly all Egyptians; however, digital platforms are rapidly gaining ground.

In 2024, Egyptians spent an average of 3 hours and 20 minutes daily watching traditional television, reflecting a 5% decrease from the previous year. This decline suggests a gradual shift in media consumption habits, with audiences increasingly favoring digital platforms.

CONCLUSION

The period from 2024 to 2025 marked a pivotal phase in Egypt’s digital evolution, characterized by substantial increases in internet penetration, enhanced connection speeds, and expanded social media engagement. These trends reflect a society increasingly embracing digital platforms, with nuanced dynamics across different demographics and platforms.

One comment

Pingback: Powering Egypt’s Digital Future: How taly Is Redefining Embedded Finance and Financial Inclusion - Taly

Comments are closed.