Our series Egyptians and Digital has chronicled Egypt’s annual cadence of clicks, likes, and scrolls for three years. Our dedication to bringing you the most up-to-date figures on Egypt’s digital habits makes our yearly analysis one of the most visited pages on our blog.

As tradition dictates, we once again delve into the depths of data to bring forth the 2024 edition, where numbers narrate the story of a society ever more intertwined with the digital world.

Unveiling “Egyptians and Digital: 2024 Report,” we see more than just numbers. We see Egypt’s digital pulse, which unearths new insights, explains evolving trends, and celebrates the country’s continued digital strides.

EGYPTIANS AND DIGITAL 2024: INTERNET USAGE IN EGYPT

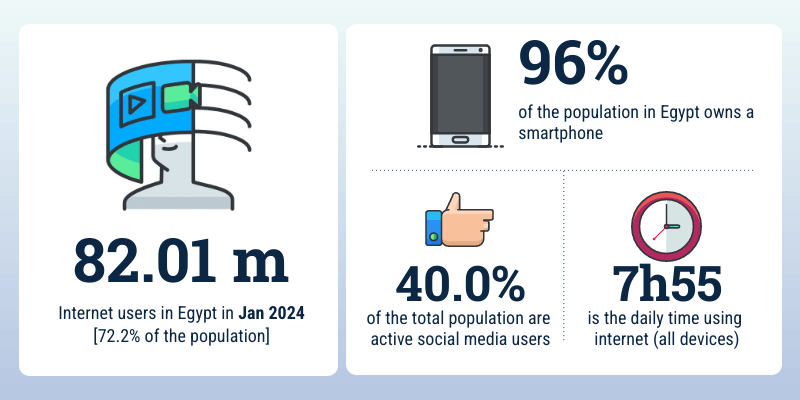

As the dawn of 2024 unfolds, Egypt’s 113.6 million-strong population continues to write its digital saga, with a notable 72% (82.01 million) of Egyptians being internet users. This figure holds steady from the previous year, suggesting a plateau that mirrors the global average.

Yet, Egypt’s youthful heart boasts a median age of 24.3, significantly younger than the global median of 30.6. This fuels a vibrant and evolving internet scene.

- A shift towards mobile-centric lifestyles and consumption patterns

In this young, digitally fluent society, smartphones reign supreme. 96% of internet users primarily access the web through mobile devices, reflecting a modest but meaningful increase year over year.

Mobile devices now command 55.8% of daily internet time, showcasing their pivotal role in Egyptians’ digital lives.

Egyptians dedicate an impressive 7 hours and 55 minutes daily to internet use, surpassing the global average of 6 hours and 40 minutes. Let’s dive into their spending habits, which provide deeper insights into their digital interactions.

Egyptians’ Online Activities Are Organized Around Sociality And Knowledge

Delving into Egyptians’ digital deeds reveals a connected culture steeped in sociality and the search for knowledge. 57.7% of Egyptians stay in touch with friends and family, weaving the social fabric of their lives through screens.

A close 56.8% turn to the internet to look for news and information, and half of the online population (50.4%) indulge in videos, TV shows, and movies, underscoring the internet’s role as a source of entertainment and relaxation.

Practicality is also prominent, with 44.5% researching how to do things and 43% finding new ideas or inspiration, speaking to the internet’s vast potential as a tool for learning and creativity.

39.1% of the population goes online for educational purposes, aligning with the young demographic’s push towards development and knowledge acquisition. Business-related research (33.8%) and networking (33.4%) indicate the Internet’s critical role in the economy and entrepreneurship.

Lastly, gaming, brand research, opinion sharing, and music round off the spectrum of activities, each with distinct user percentages, painting a diverse picture of online engagement.

Browser Preferences and Search Trends

Chrome is the browser of choice, commanding an overwhelming 81.8% share of web traffic, dwarfing other contenders like Safari and Firefox. This preference reflects global trends and indicates the importance of Egyptian users’ seamless and fast connectivity.

Egyptians navigate with intent when using search terms, as their top Google searches indicate. They seek translations, delve into local and international news, and pursue educational content, showcasing an inward-looking and outward-reaching community.

The Egyptians and Digital 2024 report indicates the population embraces the global village while nurturing local roots.

MEDIA COMPETING FOR EGYPTIAN’S ATTENTION

Adoption of Media in the Egyptian Population

Egypt demonstrates intense social media usage, with 85.0% of internet users aged 16 to 64 actively engaging with social platforms, growing +2.1 % yearly. In contrast, global social media usage has experienced a slight decline of -0.3%.

Egyptian social media engagement’s resilience amidst economic challenges can testify to its entrenched role in communication, business, and community building.

While traditional media like linear and broadcast TV have declined globally, Egypt’s drop has been more modest. 89,5% of Egyptian Internet users continue watching this type of TV, indicating that conventional media retains a firm foothold in Egyptian households despite the digital tide.

Meanwhile, streaming and on-demand TV have experienced a sharper decline (-4,7% compared to last year), perhaps influenced by economic factors.

The high inflation rates might sway viewers towards more cost-effective forms of entertainment.

Egyptians’ reading habits have shifted. 72.2% of internet users aged 16 to 64 now consume online press content, a decrease from the previous year. In contrast, physical press content readership has significantly declined, indicating a preference for digital news consumption.

This is a critical insight for publishers and content creators, emphasizing the need to adapt strategies to cater to readers’ increasingly digital preferences.

Other media have seen mixed fortunes. Listening to podcasts grew by +7.2 %. Conversely, gaming consoles and press media both declined, suggesting changing leisure preferences among Egyptians.

The current economic climate, marked by high inflation and financial uncertainty, casts a complex shadow over this digital landscape. Economic pressures can constrict household spending, potentially impeding the growth of internet access among the population.

Time Spent per Media

As we have just observed the percentage of the Egyptian population that adopted the different media (volume), we will now examine the time spent (intensity) to provide a more comprehensive understanding of media consumption habits.

On average, Egyptians spend 2 hours and 41 minutes daily on social media, an 8% increase from the previous year. This highlights the medium’s growing centrality in everyday social interaction and information exchange.

Traditional television maintains a notable presence in Egyptian homes despite a 5% decrease in time spent compared to 2023. With an average daily viewership of 3 hours and 20 minutes, broadcast content still captures a significant share of media attention.

Music streaming services and podcasts are also featured in daily routines. Egyptians dedicate 1 hour and 14 minutes to music, and there is a growing interest in podcasts, evidenced by a 9.0% increase in time spent on them, now standing at 1 hour and 10 minutes each day.

Conversely, gaming consoles and print media are experiencing declines in daily engagement. Gaming time has seen a minor dip of 2 minutes, suggesting a stabilization in its user base, while press media’s sharper decrease points to a decisive move towards digital news consumption.

Despite economic pressures, digital media resilience in Egypt reflects a transformative phase in which adapting to cost-effective and multifaceted forms of media aligns with current needs and sets the stage for future media consumption patterns in the country.

TOP 10 OF THE MOST USED SOCIAL MEDIA IN EGYPT

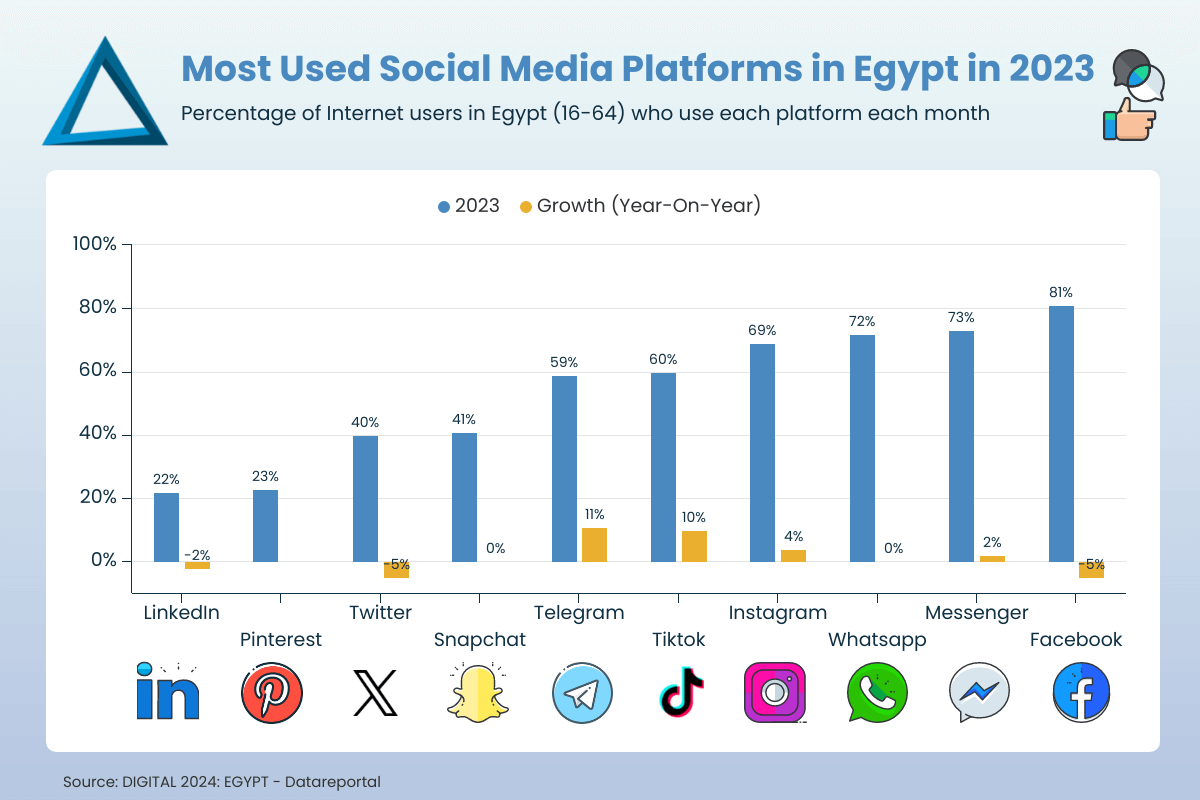

Navigating the digital currents of 2024 reveals a vibrant and dynamic social media landscape in Egypt. As we dissect usage patterns, distinct trends, and platform preferences emerge.

Egypt’s Evergreen Social Networks

Facebook and WhatsApp, two juggernauts of social connection, continue to lead the pack in Egypt. WhatsApp is now commanding second place in user preference and retaining its position as the third most used platform, proving its centrality to Egyptians’ daily communications.

While the usage rate has dipped to 81%, Facebook remains the most popular platform, with a remarkable 42 million active users who stay loyal.

Instagram’s usage rate has climbed to 69%, which speaks volumes about its rising relevance in visual and social engagement. Messenger, another pillar of the Meta empire, maintains its role as a cornerstone of communication with a 73% usage rate.

The Rise and Resilience of Video and Messaging Platforms

The platforms that serve bite-sized entertainment and fortified communication are the natural storytellers of growth. TikTok‘s meteoric rise continues unabated, with a 60% usage rate among the demographic, indicating the unabated appeal of short-form video content.

Telegram’s emphasis on security has reaped the rewards, with an 11% growth. This growth underscores users’ increasing importance on privacy in their digital interactions. It is the fastest-growing social media platform, closely followed by TikTok (+10%).

Changing Fortunes and Continued Influence

X, formerly known as Twitter, has declined its usage rate to 40%. However, it still holds a significant presence with 5.8 million active users, suggesting that while its usage may fluctuate, its influence remains potent.

In a surprising twist, Kuaishou‘s previous foothold has slipped away, giving way to Pinterest. Pinterest now garners a 23% usage rate, marking its entry into the ranking and reflecting the dynamism inherent in the social media domain.

LinkedIn endures as a network for professionals with its steady 22% usage rate and 7.9 million users, reinforcing its niche in the professional and business community.

A Deeper Dive into Digital Behaviors

But what compels Egyptians to use social media apps? Filling spare time tops the list, with 45.4% of users browsing social media for general entertainment.

Staying connected with friends and family is a close second, underscoring the importance of social platforms in maintaining personal relationships.

Other significant activities include making new contacts, following sports, and engaging with content from celebrities or influencers.

The data reveals that the public uses social media for leisure and harnesses these platforms for shopping, following news stories, and networking for work.

THE SOCIAL MEDIA GENDER GAP

The digital age has brought a magnifying glass that highlights disparities across various strata of society, including gender. The gender gap in social media usage can be seen in women’s participation compared to their demographic share.

This metric provides a window into broader issues of digital inclusion and gender equity.

Global vs. Egypt: A Comparative View

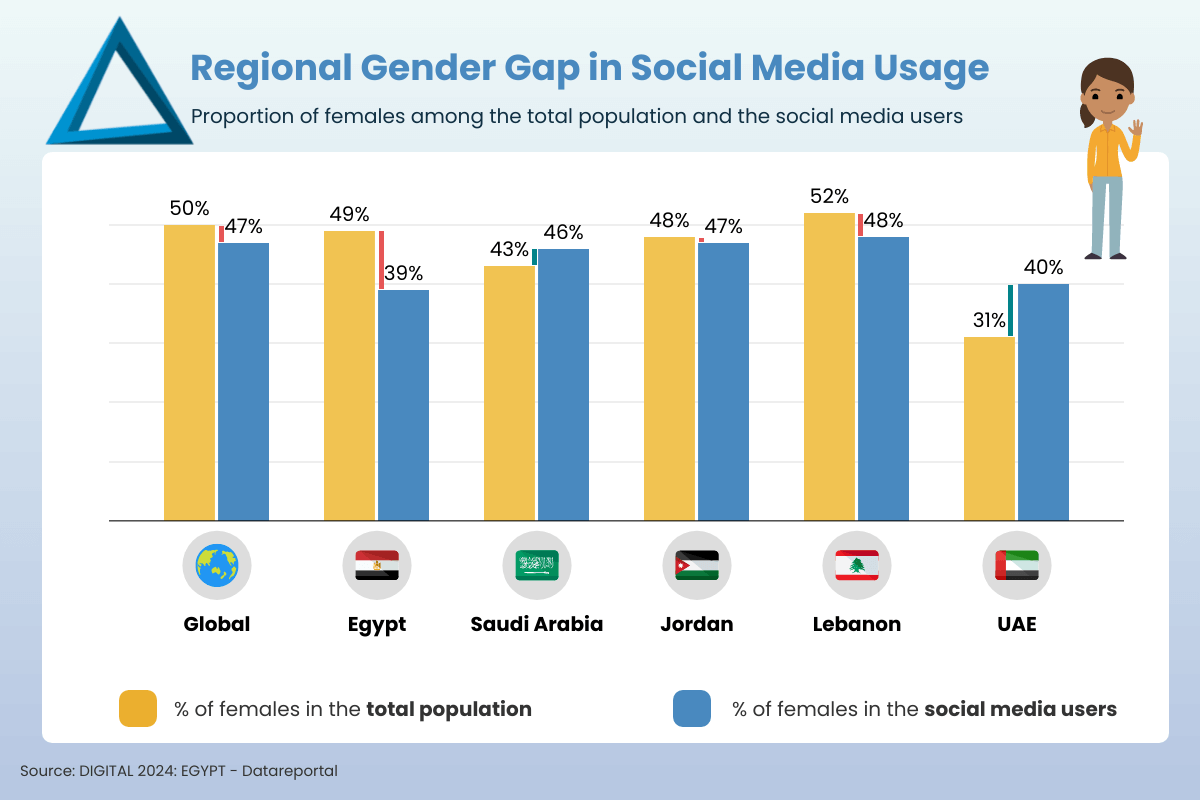

Globally, the gender gap in social media usage narrowed slightly to a 3.2% difference in 2023, with female social media users nearly catching up to their representation in the total population.

Egypt’s narrative, however, charts a different course. The 2023 figures disclose that women comprise 49.8% of the population but only 38,6% of social media users, resulting in a 10.8% gender gap.

This gap, slightly wider than the previous year, underscores the persistent divide within Egypt’s digital domain.

The social media gender gap cannot be decoupled from literacy rates, which are 69% for women and 80% for men among adults aged 15 and over. Literacy, a foundational skill for digital engagement, correlates with the gender gap in social media usage.

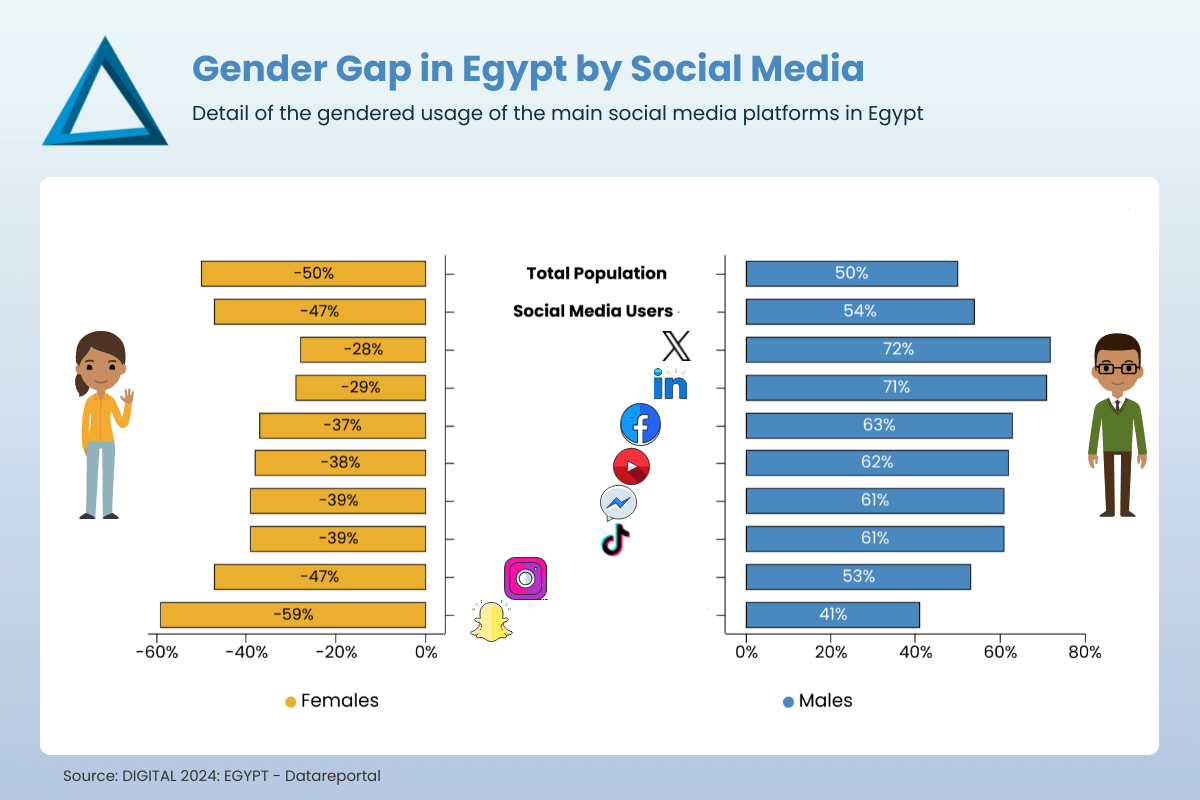

A Closer Look at Egypt’s Social Media Platforms

The divergence is further magnified when dissecting usage by platform. LinkedIn continues to exhibit the most significant gender disparity, with female representation at 29.4% in 2023, reflecting broader trends in the professional sphere.

Facebook and YouTube show similar gender distributions, with female usage at 37.8% and 37.3%, respectively.

Instagram tells a story of balance, edging closer to gender parity, with 46.8% of female users. Snapchat goes against the grain, boasting a predominantly female user base of 58.5%, a testament to the platform’s appeal among Egyptian women.

Regional Dynamics

However, the picture within the MENA region is varied. Saudi Arabia made a significant leap, with female social media users exceeding their population share by 3.3%, a notable reversal from the previous year. In contrast, Lebanon saw a widening gap, at -3.7%.

The United Arab Emirates presents an interesting case, with female social media usage exceeding the population percentage by 8.7%, indicating a dynamic where gender does not constrain digital engagement, possibly influenced by the country’s unique social and economic landscape.

Egypt could see this gap diminish over time by enhancing literacy programs, expanding digital access, and fostering an environment that encourages female participation in the digital space.

CONCLUSION AND FORWARD LOOK

As the report Egyptians and Digital 2024 indicates, digital trends in Egypt reflect regional peculiarities and global shifts. Businesses and policymakers must nuance their understanding of these shifts to foster inclusive growth and harness digital media’s potential.

As platforms evolve and new ones emerge, strategies must pivot to embrace these changes, ensuring connectivity and engagement across all segments of society.

The 2024 report offers granular insights into the digital trends and social media statistics shaping Egypt’s online landscape. The full report provides a detailed breakdown of these developments.

Follow our blogs to get frequent and updated information about Digital Egypt!