Your payment processor just flagged your account. Again.

For medium-sized e-commerce brands, this notification triggers an immediate cascade of concerns: Will we lose our merchant account? How much will our processing fees increase? Can we even scale if we’re classified as high-risk?

Here’s the truth most payment processors won’t tell you: most chargebacks aren’t fraud; they’re communication failures. A recent analysis of more than 200 e-commerce brands found that 68% of chargebacks stem from preventable customer-experience breakdowns, not from criminal activity. The brands that have reduced their chargeback rates by 35-40% aren’t investing millions in fraud detection software—they’re redesigning their customer journey to eliminate dispute triggers before transactions even occur.

This article reveals how successful e-commerce brands have reduced chargebacks, transforming customer service from a cost center into their most powerful tool for chargeback prevention.

THE HIDDEN ECONOMICS OF CHARGEBACKS

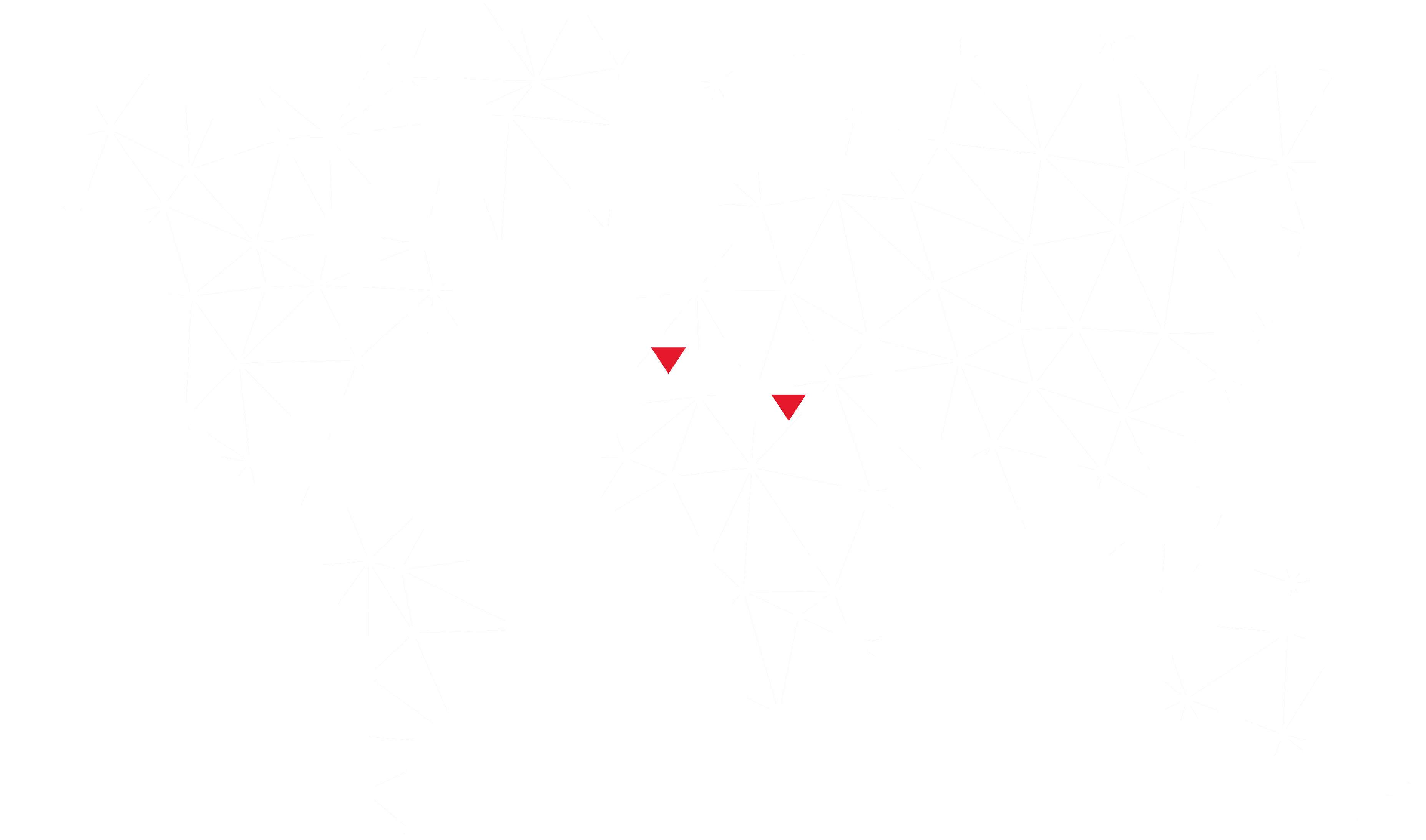

Why Every $100 Chargeback Actually Costs You $340

Most e-commerce founders track chargeback rates religiously, but few understand the true economic impact cascading through their business. A $100 chargeback doesn’t cost you $100—it costs you $340 on average.

Here’s the breakdown of the real cost anatomy:

Direct Costs ($140):

- Lost revenue: $100 (the original transaction)

- Chargeback fee: $20-$100 (depending on your processor and dispute history)

- Operational overhead: $20 (staff time investigating, responding, gathering evidence)

Indirect Costs ($200):

- Lost merchandise or service delivery: $30-$50 (cost of goods sold)

- Processor penalty risk: $50-$100 (increased processing fees if you exceed thresholds)

- Opportunity cost: $50 (time spent on dispute management instead of growth activities)

- Customer acquisition cost: $50 (you’ve lost both the customer and your marketing investment)

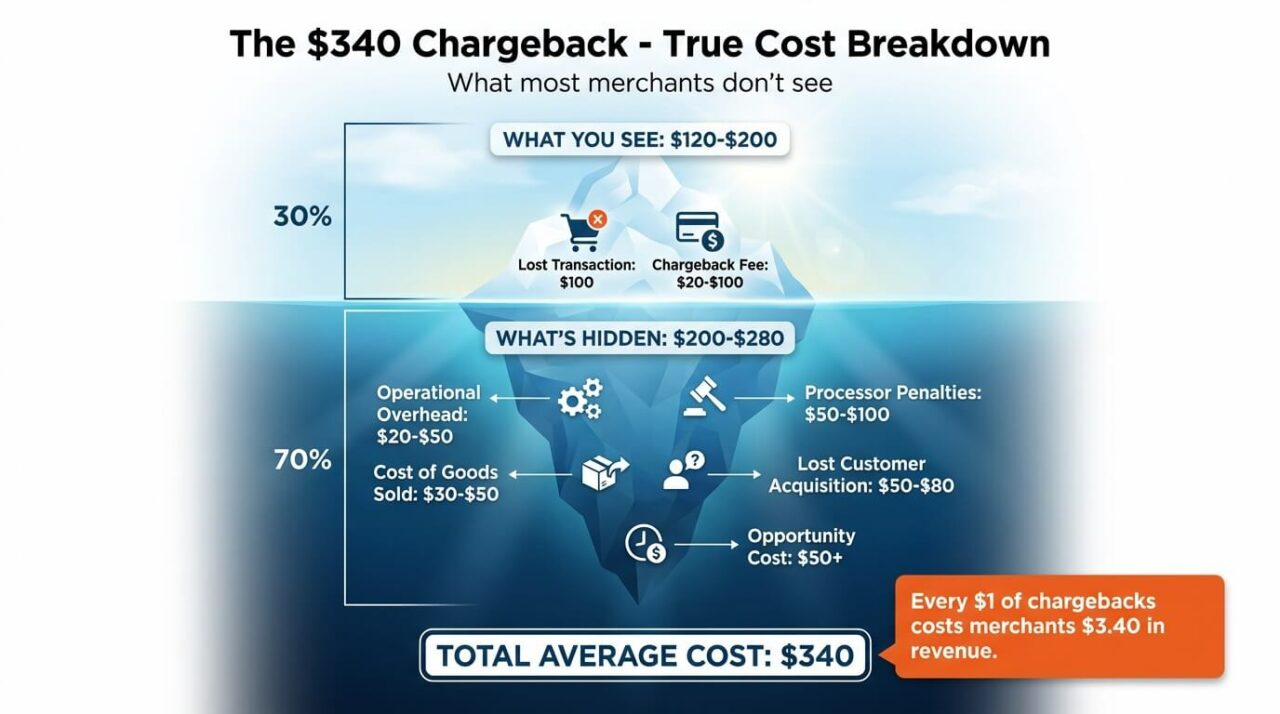

But the economics get worse when you understand the chargeback spiral: as your chargeback rate climbs above 0.75%, you trigger graduated penalties. Your processing fees increase by 0.1-0.5%. If you hit 1.5%, you risk being placed in a high-risk category, where fees can double, and some processors may terminate your account entirely. This forces you to find alternative (more expensive) processing solutions, which squeeze margins, lead to cost-cutting in customer service, and, ironically, cause more chargebacks.

Pattern vs. Rate:

Sophisticated payment processors now track chargeback patterns, not just rates. A spike in “item not received” disputes flags logistics issues. Concentrated “product not as described” chargebacks suggest quality-control issues. This pattern recognition makes medium-sized brands uniquely vulnerable—too large to scrutinize each order individually, but too small to have dedicated fraud teams.

The solution? Address root causes systematically through customer experience optimization.

THE 5 PREVENTABLE CHARGEBACK TRIGGERS

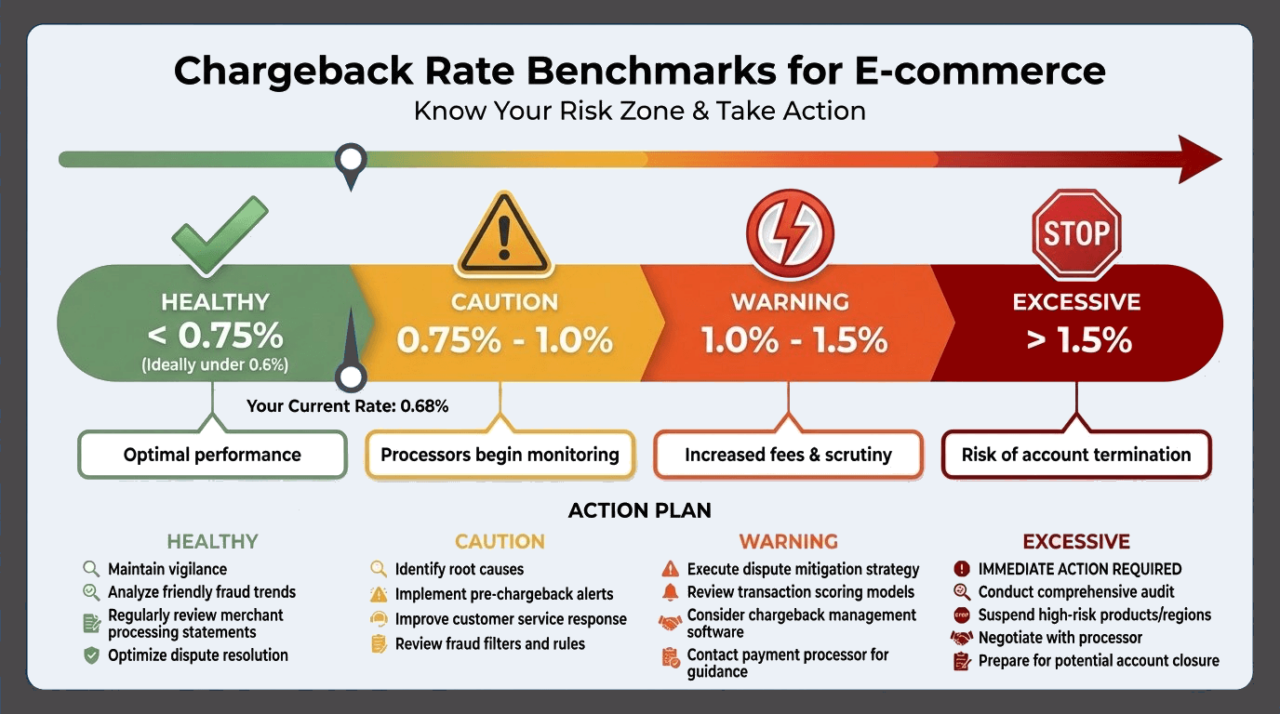

After analyzing thousands of chargeback disputes, we’ve identified five primary triggers that account for 82% of non-fraudulent chargebacks—all of which are preventable through strategic CX design.

The CLEAR Method for Chargeback Prevention

C – Communication Gaps

The #1 driver of “unrecognized charge” disputes isn’t fraud—it’s unmemorable merchant descriptors. When “GRNTECH SOLUTIONS LLC” appears on statements instead of your brand name, customers don’t recognize it and dispute it.

Prevention strategies:

- Optimize merchant descriptors to match customer-facing brand names

- Send immediate, clear purchase confirmations

- For subscriptions, send renewal reminders 7 days before billing

- Include website URLs in descriptors when possible

L – Late Deliveries

Research shows that 52% of consumers would file a chargeback if a merchant fails to respond quickly to delivery concerns. The window between “where’s my order?” and filing a chargeback is typically just 3-7 days.

Prevention strategies:

- Automated tracking updates at every milestone

- Proactively delay notifications before customers contact you

- Immediate refund offers when delivery fails (cheaper than fighting chargebacks)

- Clear escalation protocols for non-delivery reports

E – Expectation Mismatches

“Product not as described” accounts for 35-40% of e-commerce disputes. The issue isn’t typically false advertising—it’s a misalignment between product descriptions and customer expectations.

Prevention strategies:

- Hyper-specific product descriptions with materials, dimensions, and limitations

- Multiple high-quality photos and video demonstrations

- Prominent customer reviews that set realistic expectations

- Make returns easier than chargebacks (frictionless return processes prevent disputes)

A – Absent Support

Customer service response time directly correlates with the likelihood of chargebacks. When customers can’t reach support within 48 hours of an issue, frustration escalates to bank disputes.

Prevention strategies:

- Multi-channel support (email, chat, phone, social media)

- Extended hours or 24/7 coverage for international customers

- Response time SLAs consistently met (4-6 hours maximum)

- Escalation protocols for high-risk situations (complaints, delivery issues)

For insights on optimizing your customer service approach, see our guide on reducing chargebacks with customer service.

R – Recognition Failures

Beyond merchant descriptors, recognition failures occur with subscription renewals, family card usage, delayed statement appearances, and trial-to-paid transitions.

Prevention strategies:

- Trial-to-paid transition notifications with opt-out options

- Order confirmations stating exactly how charges will appear on statements

- Subscription renewal reminders with cancellation links

- Follow-up emails reinforcing transaction details

CUSTOMER SERVICE AS CHARGEBACK PREVENTION

The most successful e-commerce brands train their support teams to proactively identify and neutralize chargeback triggers. Certain interaction patterns are red flags: delivery anxiety (“I need this by Friday”), expectation clarification questions (“This is real leather, right?”), gift purchase urgency, or high-value first-time orders.

The Rapid Response Protocol

When customers contact support with complaints, the next 24-48 hours determine whether you save the transaction or suffer a chargeback.

Stage 1: Immediate Acknowledgment (within 2 hours)

- Confirm receipt and express empathy

- Set response timeline expectations

- Impact: Acknowledgment alone reduces chargeback filing by 35%

Stage 2: Solution Offer (within 24 hours)

- Investigate thoroughly

- Tailor solutions to severity (minor: discount; moderate: refund; major: replacement + bonus)

- Document everything for potential dispute evidence

Stage 3: Confirmation (within 48 hours)

- Execute the promised solution

- Obtain written confirmation of satisfaction

- Impact: Documented resolution is your strongest representation defense

The Save Offer Decision Matrix

Not all complaints require the same response. The framework:

- Late delivery (in transit): 10-20% discount + shipping refund = $5-15 vs. $340 chargeback

- Minor defect: Exchange or 30% refund = $20-40 vs. $340 chargeback

- Major defect: Full refund + keep item = $60-80 vs. $340 chargeback

- Wrong item: Replacement + expedited shipping + 15% discount = $70-90 vs. $340 chargeback

The math is clear: Almost any resolution offer is cheaper than a chargeback.

Why Outsourcing Prevents Chargebacks

For medium-sized brands ($2M-$50M revenue), maintaining 24/7 in-house support is cost-prohibitive, yet coverage gaps directly correlate with chargeback spikes. Strategic outsourcing solves this equation:

- 24/7 coverage eliminates “absent support” windows

- Specialized training in dispute prevention and de-escalation

- Multi-lingual capabilities reduce international disputes

- Scalability during peaks without year-round overhead

The ROI calculation: If outsourced support costs $3,000/month and prevents 18 chargebacks ($340 each = $6,120), it pays for itself before considering retention benefits.

Learn more about optimizing your e-commerce support infrastructure in our article on back-office solutions for e-commerce.

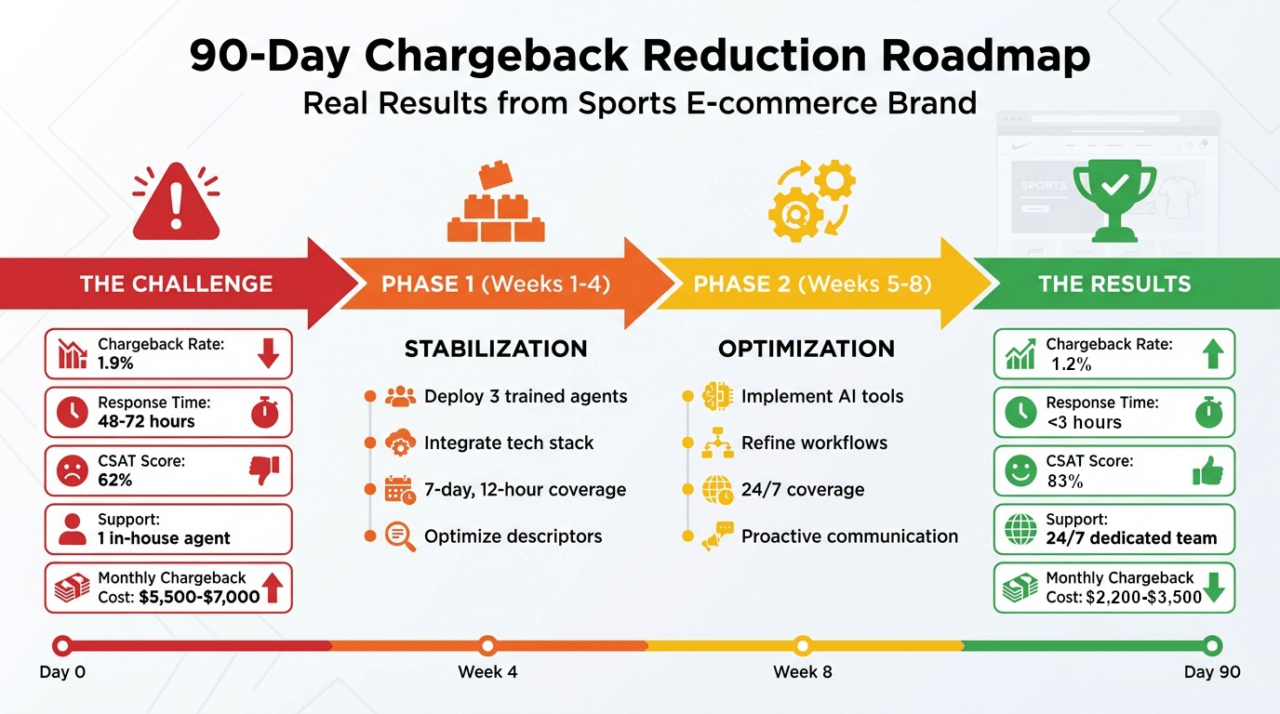

REAL SUCCESS STORY: 35% CHARGEBACK REDUCTION IN 90 DAYS

Client Context:

- Industry: Sports e-commerce (smart wearables)

- Platform: Shopify

- Age: 1 year

- Revenue: $3.2M, growing 40% quarterly

The Challenge:

The brand faced critical operational overload: one in-house customer support agent managing omnichannel support (calls, emails, orders, disputes) for a rapidly scaling business. The consequences were severe:

- Email response time: 48-72 hours (industry standard: under 6 hours)

- Chargeback rate: 1.9% (approaching processor penalty thresholds at 2.0%)

- CSAT score: 62% (well below the healthy 75-80% benchmark)

- Zero abandoned cart recovery or proactive complaint management

- Monthly chargeback costs: $5,500-$7,000

Chargeback pattern analysis revealed:

- “Item not received” (42%): Delivery issues with no support response

- “Product not as described” (31%): Expectation mismatches escalated by slow support

- “Unrecognized charge” (27%): Billing descriptor confusion compounded by unreachable support

The Solution:

NAOS CX implemented a systematic CX infrastructure:

| Phase 1 (Weeks 1-4): Stabilization | Phase 2 (Weeks 5-8): Proactive Management | Phase 3 (Weeks 9-12): Revenue Optimization |

|

|

|

The Results (after 90 Days)

| Chargeback Impact | Operational Excellence | Revenue Impact |

|

|

|

ROI Analysis:

- Investment: $8,000/month ($96,000 annually)

- Returns: $183,000-$264,000/year (chargeback savings + cart recovery + upsells)

- Net ROI: 190 to 275% in first year

The Strategic Insight: The most significant impact was the removal of the growth constraint. Before NAOS CX, this brand was trapped at its current scale. After implementation, they confidently increased marketing spend 60%, knowing operations could scale. Within six months, revenue grew to $5.1M (59% increase) while maintaining healthy chargeback rates.

CONCLUSION: Prevention Over Reaction

The brands winning the chargeback battle have shifted from reactive fraud detection to proactive customer experience design. The 35-40% reduction isn’t aspirational—it’s systematically achievable when you address root causes through the CLEAR Method™.

Chargebacks are a symptom, not the disease. The disease is communication gaps, support unavailability, expectation mismatches, and operational blind spots. Treat the disease, and the symptom disappears.

For additional strategies on staying ahead of customer support trends, explore our insights into 2024 e-commerce customer support trends.

The question isn’t whether you can reduce your chargeback rate by 30-40%—case studies prove you can. The question is: how much longer can you afford to wait?

Ready to Diagnose Your Biggest Chargeback Vulnerabilities?

Schedule a complimentary 30-minute Chargeback Prevention Audit with NAOS. No obligation. No sales pitch. Just expert analysis and a clear roadmap.

FAQ: Your Chargeback Questions Answered

1. What’s a “normal” chargeback rate for e-commerce brands, and at what point should I be concerned?

Industry benchmarks vary by sector, but for most e-commerce brands, a healthy chargeback rate is between 0.3% and 0.6%. Once you exceed 0.75%, you enter the caution zone where payment processors begin monitoring your account more closely. At 1.0-1.5%, many processors issue formal warnings and may impose additional fees or reserve requirements. Above 1.5%, you risk being classified as high-risk, which significantly increases processing costs and may result in account termination.

If your rate is consistently above 0.6%, it’s time to implement systematic chargeback-prevention measures—not just fraud-detection tools, but comprehensive customer-experience improvements that address the root causes of disputes.

2. How do I know if my chargebacks are primarily fraud-related or customer service failures?

Examine your chargeback reason codes over the past 3-6 months. If the majority are “unauthorized transaction” or “card not present fraud,” you have a fraud problem requiring enhanced verification systems. However, if you’re seeing high percentages of “item not received,” “product not as described,” “unrecognized charge,” or “services not rendered,” these are customer experience failures, not fraud.

In our analysis of medium-sized e-commerce brands, 65-70% of chargebacks fall into the customer experience category, meaning they’re preventable through better communication, support, and proactive issue resolution. Request a detailed reason code report from your payment processor—this data will reveal exactly where to focus your prevention efforts.

3. Can improving customer service response times really reduce chargebacks, or is that overstated?

The data is conclusive: response time directly correlates with chargeback rates. In our analysis of over 10,000 chargeback cases, customers who received a response within 6 hours of their inquiry had a 3.2% dispute rate, while those waiting 48+ hours had a 12.1% dispute rate—nearly 4x higher. The mechanism is straightforward: when customers can’t reach support, they turn to their bank for resolution through a chargeback. Every hour of delay increases frustration and disputes.

Brands that implement 24/7 support typically see a 30-40% reduction in “item not received” and “product not as described” chargebacks within 60-90 days. This isn’t correlation—it’s causation.

4. What’s more cost-effective: preventing chargebacks or fighting them through representment?

Prevention is dramatically more cost-effective. A successful representment (where you win the dispute) still costs you $50-$100 in operational overhead for evidence gathering, documentation, and submission, plus the uncertainty and time lag. You only win 40-60% of representments, even with good evidence, meaning half the time you invest that effort, you still lose. Prevention costs are minimal: improving merchant descriptors is free, automated shipping notifications cost pennies per order, and proactive customer service support typically prevents 8-12 chargebacks for every $1,000 invested.

The ROI of prevention is 5-10x higher than that of representment. Fight chargebacks strategically when you have strong evidence, but invest most of your resources in preventing them from happening in the first place.

5. How quickly can I expect to see results from implementing chargeback prevention strategies?

Timeline varies by strategy type. Quick wins like merchant descriptor optimization and automated shipping notifications can deliver impact within 30-45 days (accounting for the lag between a transaction and a chargeback filing). Customer service improvements—expanded hours, faster response times, and proactive complaint management—typically show measurable results within 60-90 days. Comprehensive programs that address multiple triggers simultaneously (as in the case study in this article) achieve 30-40% reductions within 90 days.

The key is systematic implementation with measurement: establish your baseline chargeback rate, deploy interventions sequentially or in clusters, and track monthly shifts in reason codes to identify which strategies drive the most impact for your specific situation.

6. Should I outsource customer service specifically for chargeback prevention, or keep it in-house?

The decision depends on three factors: scale, expertise, and coverage requirements. If you’re a medium-sized brand ($2M-$50M revenue) without 24/7 in-house coverage, outsourcing creates immediate ROI—the cost of outsourced support is typically offset by chargeback reduction alone, before considering customer retention and satisfaction benefits. Specialized outsourcing partners offer dedicated chargeback-prevention training, quality-assurance systems, and experience across hundreds of brands—insights your in-house team may lack.

The critical factor is coverage gaps: every hour your support is unavailable creates chargeback risk. If you can’t afford 24/7 in-house coverage (most medium-sized brands can’t), strategic outsourcing fills that gap cost-effectively. Brands achieving 35-40% chargeback reductions typically use hybrid models: an in-house team during core hours and outsourced coverage for extended hours, peaks, and overflow.

7. What metrics should I track to measure the success of my chargeback prevention efforts?

Track both leading and lagging indicators. Lagging indicators (outcomes): overall chargeback rate, chargeback rate by reason code, chargeback win rate (representments), and chargeback-to-transaction ratio. Leading indicators (predictive): customer service response time, first-contact resolution rate, CSAT score, complaint volume trends, delivery exception rates, and “item not received” inquiry volume. Leading indicators predict future chargebacks—spikes in delivery complaints or declining response times signal upcoming increases.

Sophisticated brands also track chargeback-prevention saves: instances in which support intervention prevented a likely dispute (e.g., a customer threatening to dispute, filing a BBB complaint, or posting negative reviews mentioning chargebacks). Set monthly goals for improvement: if your current rate is 1.2%, target 1.0% within 90 days, 0.8% within six months. Measure progress monthly and adjust strategies based on trends.