Attracting and retaining top talent for organizations requires the Talent Acquisition department to monitor recruitment KPIs and analytics closely. The increasing competition in the job market has made it essential for HR departments to leverage the expertise of recruitment agencies to find suitable candidates.

However, simply outsourcing the recruitment process is not enough to ensure success. It’s crucial to track key performance indicators (KPIs) to align the Recruitment Agency with your Talent Acquisition objectives and measure the effectiveness of the relationship between both entities.

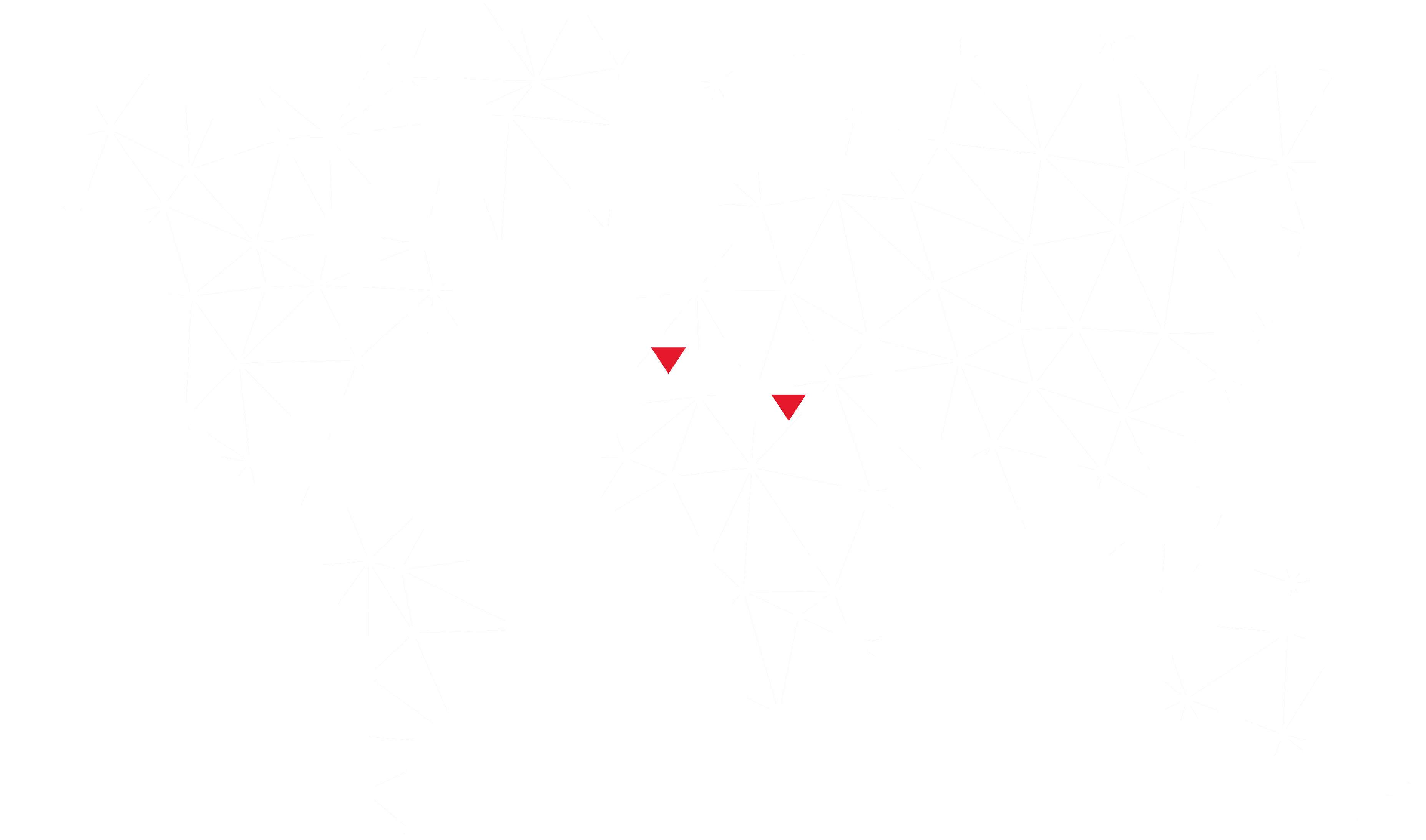

In this blog post, we’ve identified six main categories of recruitment KPIs and metrics that HR departments should monitor to ensure they are aligned with their recruitment partners and working towards a common goal.

- The sourcing and application process

- The efficiency of the hiring process

- The Candidates’ Fit

- Communication and collaboration with the recruitment agency

- Employer branding and company attractiveness

- The Costs

In addition, we recommend tracking the agency’s capacity to deliver volumes through specific measures. By monitoring these seven categories of recruitment KPIs and measures, HR departments can ensure they effectively align with their recruitment partners and attract and retain top talent.

Read our latest article on talent acquisition analytics to gain a deeper understanding of how advanced metrics can enhance hiring efficiency.

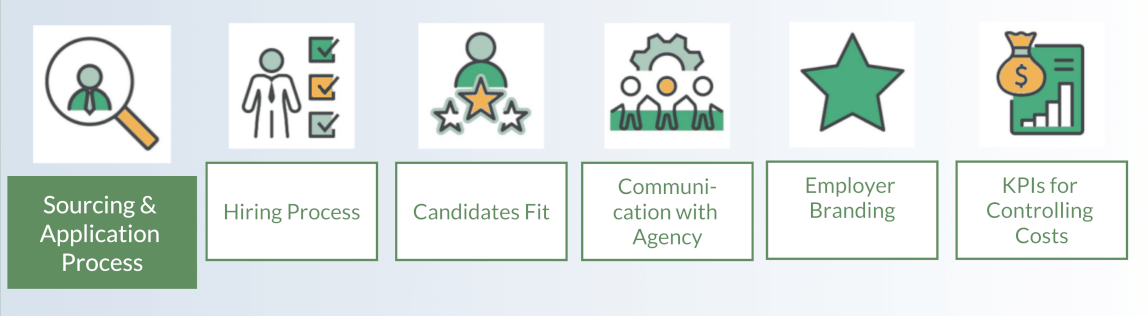

KPIs To Monitor The Sourcing And Application Process

This category of Recruitment KPIs allows you to evaluate the effectiveness of the recruitment agency’s sourcing process, including the number of applications received and the quality of the applicants.

Source of candidates

The source of candidates is one of the most important KPIs to monitor. It’s a metric that will give you a clear picture of where your best candidates come from, which sources need increased investment, and which ones you should cut off altogether.

You can track sources by looking at how many candidates came from each source, the hiring (or rejection) percentage, and the money spent on each source. The most common sources of candidates are:

- Job boards and career websites include popular job search engines and industry-specific job boards.

- Employee referrals are the candidates from existing employees referring their friends and contacts.

- Social media enclose tracking every social media platform used to publish your job offers, such as LinkedIn, Twitter, Facebook, and even WhatsApp.

- Career fairs and recruitment events include tracking the number of hires from career fairs, campus events, and other recruitment events.

- Direct applications include tracking the number of candidates from candidates who apply directly through the company’s career website or sending a spontaneous resume.

- Recruitment agencies include tracking the number of candidates from recruitment agencies or headhunters.

You should be able to monitor all the steps of the recruitment funnel breakdown by source. Monitoring these sources can help identify potential recruitment issues, such as a low conversion rate from a particular source.

Job offer bounce rate

The bounce rate of your job offers is the percentage of candidates who did not complete their applications through your career website. This metric helps you understand why candidates are not accepting proposals.

For example, if your bounce rate for a particular role is higher than usual, it could be due to the requirements for that role being too demanding or strict. Alternatively, if your bounce rate is lower than expected, perhaps something missing from your recruitment process needs improvement.

Candidate conversion rate by source

This measures the conversion rate of candidates from different sources, such as job boards, employee referrals, or social media.

You can calculate this KPI by dividing the number of hires from a particular source by the total number of candidates who applied.

Candidate response rate

This measures the percentage of candidates who respond to recruitment efforts.

You can calculate this KPI by dividing the number of candidates who respond to a recruitment effort, such as an email or phone call, by the total number of candidates contacted.

Candidate sourcing efficiency

This measures the effectiveness of the sourcing strategies to identify and attract potential candidates.

You can calculate this KPI by dividing the total cost of sourcing candidates by the number of hires from that source.

Offer acceptance rate by source

This measures the acceptance rate of job offers by candidates from different sources.

You can calculate this KPI by dividing the number of candidates who accept a job offer by the total number of candidates offered a job from a particular source.

Candidate Rejection rate

The rejection rate is the percentage of applicants immediately rejected after receiving their application. It happens when the applicant does not meet the minimum requirements set. The rejection rate provides information on whether your job advertisement reached suitable applicants and also says something about the effectiveness of your job advertisement.

The wrong recruiter channel also significantly impacts the rejection rate. If you notice a high rejection rate, you are not reaching the desired target group of candidates. Therefore, consider your job advertisement and check whether it contains all the necessary information for the applicant.

You can calculate this KPI by dividing the number of candidates rejected during the first screening of candidates by the total number of candidates who applied.

Talent pipeline depth

This measures the size and quality of the pool of potential candidates developed for future hiring needs. It helps identify areas for improvement in the recruitment process.

This KPI is complex to compute manually, but you can quickly do it with an Applicant Tracking System (ATS).

To calculate the Talent pipeline depth KPI, you can follow these steps:

- Define the stages in your recruitment process: Start by identifying the different stages in your recruitment process, such as sourcing, application, resume review, first-round interview, second-round interview, and offer.

- Track the number of candidates in each stage: Keep track of the candidates currently in that stage.

- Determine the target pipeline depth: Establish a target pipeline depth for each stage of the recruitment process based on your company’s hiring needs, historical data, and other relevant factors. Remember to consider external factors that may impact your target pipeline depth, such as changes in the job market or the competitiveness of a particular role.

- Calculate the talent pipeline depth: To calculate the talent pipeline depth, divide the number of candidates in each stage of the recruitment process by the target pipeline depth for that stage.

- Monitor and adjust: Regularly monitor the depth of your talent pipeline and adjust your sourcing and recruitment efforts to maintain a healthy pipeline of potential candidates.

Candidate diversity by source

This measures the diversity of candidates from different sources.

You can calculate this KPI by tracking candidate demographic information, such as gender, ethnicity, and age, and comparing it to the overall candidate pool.

Candidate pool diversity

This measures the diversity of the pool of candidates considered for open positions.

You can calculate this KPI by tracking the demographic information of all candidates in the pool, such as gender, ethnicity, and age, and comparing it to the overall population.

Recruitment KPIs To Monitor the Efficiency of the Hiring Process

By monitoring a recruitment agency’s efficiency, you can make informed decisions about your staffing needs and ensure that you are getting the best value for your investment. You can also guarantee that your recruitment process is cost-effective, efficient, and meets your organization’s needs.

You will find below some recruitment KPIs examples to monitor the efficiency of the hiring process:

Candidate assessment accuracy

This measures the accuracy of the assessment tools and processes used to evaluate candidates.

You can calculate this KPI by comparing hired candidates’ performance to pre-employment assessment scores.

Position conversion rate

This measures the percentage of converted candidates from applicants to the position.

Calculate this KPI by dividing the number of hired candidates by the total number of candidates who applied to a specific position.

Candidate drop-off rate

This measures the percentage of candidates who drop out of the hiring process before receiving an offer.

You can calculate this KPI by dividing the number of candidates who drop out of the recruitment process by the total number of candidates who applied.

A high drop-out rate can indicate a need to improve the candidate experience.

Candidate engagement

This measures candidates’ engagement level with the recruitment process.

We calculate this KPI by tracking candidates’ engagement levels throughout the recruitment process, such as the number of candidates who attend scheduled interviews, the number of follow-up communications, and the number of candidates who accept job offers.

Candidate experience

This qualitative KPI measures candidates’ satisfaction with the recruitment process. Various methods, such as surveys, exit interviews, or even following candidate feedback at multiple stages of the process, allow for evaluating how well recruiters have treated candidates throughout the process.

The Candidate Experience survey is a short survey to measure the satisfaction of the candidates by asking them questions like:

- How would you rate your overall experience during the recruitment process?

- How clear were the job description and requirements provided to you?

- Was the recruitment process fair and transparent?

- How responsive were the recruiters and HR team during the process?

- How well were you informed about the next steps in the process?

- How long did you wait for a response after submitting your application?

- Were the interviewers prepared and knowledgeable about the role and the company?

- Was the interview process respectful and professional?

- Was the time and location of the interview convenient for you?

- How satisfied are you with the outcome of the recruitment process, whether it be an offer or rejection?

Then, you can use these results to continuously improve the candidate experience, increasing candidate satisfaction and a positive perception of the organization as an employer.

Candidate no-show rate

This measures the percentage of candidates who do not show up for interviews or other appointments.

You can calculate this KPI by dividing the number of candidates who fail to attend a scheduled interview or event by the total number of invited candidates.

Quality-of-hire

This measures the overall effectiveness of the hiring process in terms of the fit and performance of new hires.

This KPI can be measured by tracking the performance of new hires, such as their retention rates, job performance, and promotions, and comparing it to the performance of similar hires from previous periods.

Time-to-fill by role

This measures the time-to-fill for a position in days, weeks, or months, depending on the industry and type of job.

You can calculate this KPI by measuring the time elapsed between posting a job and hiring a candidate for that role.

Time to fill isn’t just an indicator of performance—it is also a benchmark for growth. If your agency has been around for over a few years, then you should compare its time-to-fill rate today with its rate from three years ago (or whatever amount of time you’re comfortable with) to monitor the evolution.

Recruitment agency’s Time-to-fill

This measures the average elapsed time for the agency to fill the open positions.

The recruitment agency’s time-to-fill can be calculated by adding the elapsed time for all the job placements made by the recruitment agency, divided by the number of positions filled.

A lower time-to-fill indicates that your agency can fill positions quickly. It shows that their talent acquisition process is efficient and effective.

Time-to-start

This measures the time it takes for a new hire to start work after accepting an offer.

You can measure this KPI by calculating the time from job offer acceptance to the start date.

Fill rate

The Fill rate provides insight into the agency’s effectiveness in filling open positions and the number of unfilled positions over a given time.

You can calculate this KPI by dividing the number of positions filled by the total number of open positions.

Considering the time frame and context when interpreting the fill rate is essential. A high fill rate over a short period may indicate a robust recruitment process. Still, a low fill rate over a more extended period may tell that the company needs to re-evaluate and improve its recruitment process.

Interview-to-offer ratio

The Interview-to-offer ratio is the number of jobs offered divided by the number of interviews conducted. For example, if a recruitment agency conducts 100 interviews and makes 50 job offers, the Interview-to-offer ratio would be 50%.

A high Interview-to-offer ratio means the sourcing quality is high and the recruitment process is efficient and effective. Otherwise, you will need to identify areas for improvement, either in the sourcing or the recruitment process.

Source of hire

It is highly relevant for a Talent Acquisition Manager to keep track of recruitment sources. The most common sources of hire are:

- Job boards and career websites

- Employee referral

- Social media

- Career fairs and other recruitment events

- Direct applications

- Recruitment agencies or headhunters

By monitoring these sources, Talent Acquisition Managers can better understand where their hires are coming from and allocate their recruitment efforts more effectively.

Recruitment KPIs To Monitor The Candidates’ Fit

Assess the fit of candidates with the company culture, values, and job requirements.

Onboarding success rate

The onboarding success rate measures the effectiveness of the onboarding process in integrating new hires into the company culture and ensuring they have a clear understanding of their roles and responsibilities. It reflects how well new hires can perform their job effectively after onboarding.

It can be calculated by dividing the number of successful onboardings by the total number of new hires during a specified period.

Retention rate

The retention rate is the percentage of employees who remain employed after a specified period.

Calculate it by dividing the number of employees still employed after a given period by the total number of employees at the beginning of that period.

A high retention rate indicates that employees are satisfied with their jobs, company culture, and benefits. It also suggests that the recruitment and selection process effectively attracts the right employees for the job. A low retention rate may indicate issues with working conditions, job satisfaction, or cultural fit and that changes are needed to improve employee retention.

Candidate quality

The quality of candidates is a qualitative KPI related to the success of those candidates once hired.

One way to calculate candidate quality is to evaluate their performance after onboarding and on the job for a sufficient period. You can use metrics such as job performance ratings, feedback from managers and coworkers, and promotions and retention rates to assess the quality of candidates.

Another approach is to measure the results of pre-employment assessments and reference checks to determine if they accurately predict job performance.

A high candidate quality score indicates that the candidates you are hiring are performing well in their roles and contributing to the success of your organization. A low score may reveal room for improvement in the recruitment and selection process or a need to re-evaluate the job requirements and the criteria used to evaluate candidate fit.

KPIs To Monitor The Communication And Collaboration With The Recruitment Agency

It is essential to have regular communication and collaboration with the recruitment agency to ensure that they are meeting your needs and expectations. Here are the KPIs to monitor:

Agency share rate

This is the percentage of candidates placed by an agency in permanent or temporary positions compared with other agencies.

It is calculated by adding the total number of onboarded candidates from this agency divided by the total number of onboarded candidates from all the agencies.

If a single agency’s share rate is too high, you should diversify the agencies used to distribute the risks.

Hiring Manager Satisfaction

This measures the satisfaction of your Hiring Managers regarding the recruitment process and its outcomes. It provides valuable insights into the recruitment process’s strengths and weaknesses. It is an essential indicator of the effectiveness of the relationship between the Talent Acquisition department and the recruitment agency.

You can measure the Hiring Manager’s satisfaction through regular surveys, feedback forms, or performance evaluations.

Here is an example of questions for a Hiring Manager Satisfaction Survey to repeat every time a position is filled.

Evaluate your satisfaction from 1 to 5 (1 being extremely dissatisfied and 4 being extremely satisfied) regarding the following:

- The overall recruitment process:

- The ability of the recruitment agency to find suitable candidates for the role:

- Communicating with the recruitment agency and its responsiveness:

- The capacity of the recruitment agency to provide helpful feedback and support throughout the process:

- The ability of the recruitment agency to understand the requirements and needs of the role and the company:

- The way the recruitment agency delivered on its promises and met your expectations:

- How likely are you to use the recruitment agency again in the future?

- Do you have additional comments or feedback on the recruitment agency’s performance?

To calculate Hiring Manager satisfaction, the responses to these questions can be analyzed and aggregated to produce a satisfaction score. The score can be reported on a scale from 1-5, with higher scores indicating higher satisfaction levels.

Interpreting the results of Hiring Manager satisfaction surveys requires a comprehensive understanding of the recruitment process, the goals and expectations of Hiring Managers, and the overall performance of the recruitment agency.

KPIs To Monitor Your Employer Branding And Attractiveness

You can measure the perception of your company’s employer branding and its ability to attract top talent.

Offer acceptance rate

This measures the percentage of candidates that accept the job offers.

To calculate the offer acceptance rate, divide the number of job offers accepted by the total number of job offers made during a specified period. The result is expressed as a percentage.

A low acceptance rate can indicate a need to improve the attractiveness of the job or offer and enhance your employer branding.

Employee referral rate

The Employee referral rate measures the percentage of new hires from employee referrals.

To calculate the employee referral rate, divide the number of hires made through employee referrals by the total number of hires made during a specified period. The result is expressed as a percentage.

A high employee referral rate indicates that employees are satisfied with their workplace and actively recommend it to their network, leading to high-quality hires.

Employee turnover rate

This measures the percentage of employees who leave the company within a certain period.

To calculate the employee turnover rate, divide the number of employees who leave during a specified period by the average number of employees. The result is expressed as a percentage.

A high employee turnover rate indicates that employees leave the company frequently, which can signify poor working conditions, low job satisfaction, or inadequate training. Low employee satisfaction will negatively impact your Employer branding in the medium-long run.

In terms of interpretation, it is essential to compare the results of these Recruitment KPIs against industry standards and benchmark data and to track changes over time. Additionally, it is essential to consider factors such as the economy, the job market, and company-specific circumstances that may impact these KPIs.

KPIs To Control The Recruitment Costs

Measure the cost-effectiveness of the recruitment process, including the cost-per-hire and the return on investment.

Advertising costs

This measures the cost of advertising the vacancy, including the cost of job boards, social media advertising, and other forms of promotion.

Cost-per-hire

This measures the total cost of the hiring process, including recruitment, screening, and onboarding expenses. It’s a key metric to track in your Talent Acquisition department and can be used to determine if your agency is efficient or not.

The formula for calculating cost per hire is:

- The total cost incurred / Number of new hires

The total cost incurred is the total cost of filling a vacancy, including advertising, recruitment agency fees, and any other expenses associated with the hiring process.

Cost per Interview

This measures the cost of interviews, including travel expenses for candidates and the time spent by internal staff conducting interviews.

Onboarding costs

This measures the cost of onboarding new hires, including training and orientation expenses.

Recruitment agency fees

This measures the cost of using a recruitment agency to fill a vacancy.

Sourcing channel cost per applicant

The Sourcing Channel Cost Per Applicant calculates the costs of a recruiting channel contrasted by the number of applicants. This analysis deduces which channels deliver the most applicants and which ones you should concentrate on. This allows you to determine how much each channel costs and how many applications it leads to.

Measures To Monitor The Recruitment Agency’s Capacity To Deliver Volumes

Evaluate the recruitment agency’s ability to deliver the desired candidates in a specific time frame. For this, you must keep track of some measures, even if they are not strictly speaking KPIs.

Number of job openings

The number of job vacancies (with a single job description) opened over a certain period (e.g., year-to-date).

Number of positions to fill

The number of positions filled over a certain period. A job opening can serve to fill two or more positions.

Number of applicants

The number of unique applications received over a certain period.

Number of newly hired

The number of people onboarded over a certain period.

Conclusion

As we’ve seen, many ways to measure recruitment agency performance exist.

Recruitment analytics are critical to your Talent Acquisition Department’s business intelligence gathering. They help you understand the impact and effectiveness of your work and identify new opportunities for improvement in an ongoing cycle of continual growth. Measuring your recruitment KPIs can lead you to make data-driven decisions that improve your ROI and grow your business.

If you’re a Talent Acquisition Manager seeking to enhance your recruitment strategies and achieve better outcomes, look no further than NAOS Talents. Our team of experts can assist you in navigating through recruitment analytics and offer custom solutions that fit your specific requirements. From implementing a Recruitment KPIs measurement plan to attracting top talent, NAOS Talents has the experience and resources to support your success. Don’t miss this chance to elevate your recruitment efforts.

Reach out to NAOS Talents now to discover how we can assist you in reaching your recruitment objectives.